- Understanding Profit Margins: A Guide to Using a Profit Margin Calculator for Small Businesses

- What are Profit Margins?

- Why Use a Profit Margin Calculator?

- Using a Profit Margin Calculator: A Practical Example

- Step 1: Gather Revenue and Cost Data

- Step 2: Calculate Gross Profit

- Step 3: Calculate Gross Profit Margin

- Analyzing the Results

- Conclusion

Understanding Profit Margins: A Guide to Using a Profit Margin Calculator for Small Businesses

Profit margin calculator small business example provides invaluable insights for entrepreneurs looking to measure their financial performance. Knowing how to determine your profit margins is essential for successful business management, enabling you to set pricing strategies, assess profitability, and make informed decisions. This article will help you understand what profit margins are, why they matter, and how to utilize a profit margin calculator effectively with a practical example.

What are Profit Margins?

Profit margins represent the percentage of revenue that exceeds the total costs of production. Essentially, they indicate how efficiently a company is turning sales into actual profit. There are several types of profit margins, including gross profit margin, operating profit margin, and net profit margin. Each provides unique insights into different aspects of a business’s financial health.

-

Gross Profit Margin is calculated by subtracting the cost of goods sold (COGS) from total revenue and dividing that figure by total revenue. This margin showcases how well a company uses its resources to produce goods or services.

-

Operating Profit Margin includes both COGS and operating expenses, offering a broader view of a company’s profitability after accounting for all costs except taxes and interest.

-

Net Profit Margin reflects the percentage of revenue remaining after all expenses, including taxes and interest, have been deducted.

Why Use a Profit Margin Calculator?

A profit margin calculator small business example simplifies the process of calculating these margins, allowing small business owners to quickly assess their financial performance. With a clear understanding of profit margins, business owners can:

-

Set Competitive Prices: Knowing your profit margins helps you price your products or services competitively while ensuring profitability.

-

Identify Trends: Monitoring profit margins over time can help identify trends in your business, enabling you to adjust strategies accordingly.

-

Evaluate Performance: By comparing profit margins to industry benchmarks, you can assess how well your business is performing relative to competitors.

Using a Profit Margin Calculator: A Practical Example

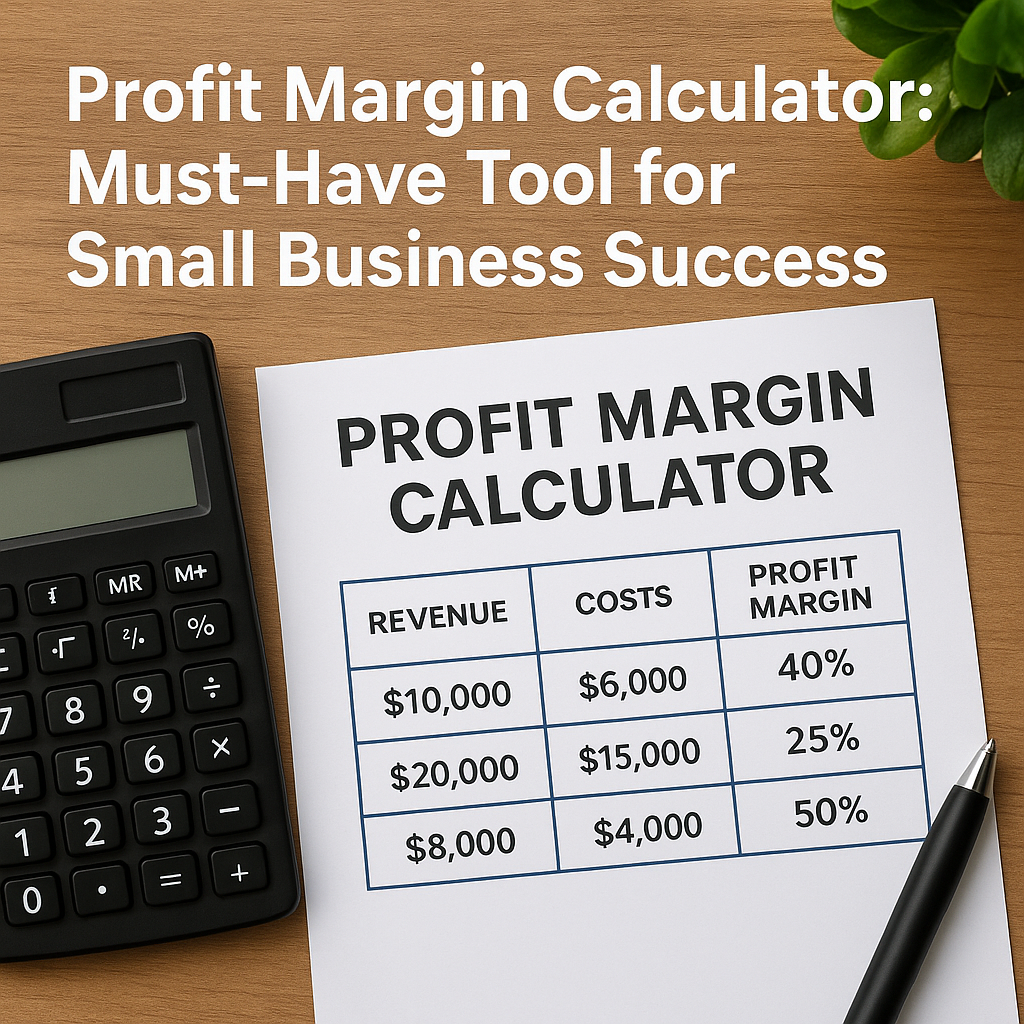

Let’s consider a fictional small business called “Jane’s Handmade Crafts.” Jane creates unique crafts and sells them for a profit. To illustrate the use of a profit margin calculator, let’s say she wants to compute her gross profit margin.

Step 1: Gather Revenue and Cost Data

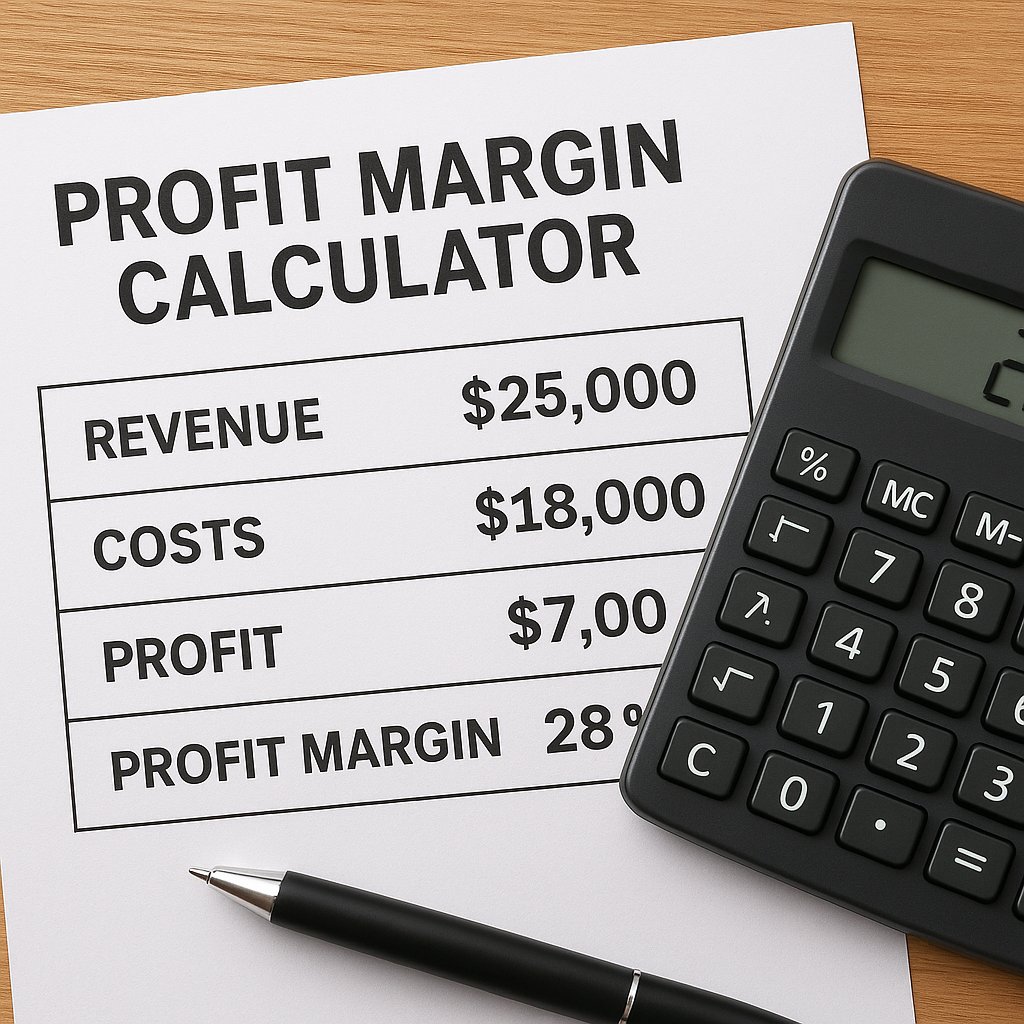

Jane sells her crafts for a total of $10,000 in a given month. Her total expenses for the materials and production (COGS) amount to $4,000.

Step 2: Calculate Gross Profit

To find Jane’s gross profit, she subtracts her COGS from total revenue:

[ text{Gross Profit} = text{Total Revenue} – text{COGS} ]

[ text{Gross Profit} = 10,000 – 4,000 = 6,000 ]

Step 3: Calculate Gross Profit Margin

Now that Jane knows her gross profit, she can calculate her gross profit margin:

[ text{Gross Profit Margin} = left( frac{text{Gross Profit}}{text{Total Revenue}} right) times 100 ]

[ text{Gross Profit Margin} = left( frac{6,000}{10,000} right) times 100 = 60% ]

Jane’s gross profit margin of 60% means she retains 60 cents of every dollar earned from sales after covering the direct costs of production.

Analyzing the Results

With a gross profit margin of 60%, Jane can confidently assess her pricing strategy. This figure allows her to cover her operating expenses, reinvest in her business, and achieve her desired net profit. If industry standards indicate that the average gross profit margin for handmade crafts is around 45%, Jane can feel assured that she is operating efficiently.

Conclusion

Using a profit margin calculator small business example illustrates how straightforward it can be for small business owners to analyze their financial health. By understanding and calculating profit margins, entrepreneurs like Jane can make better pricing decisions, evaluate performance against industry standards, and identify areas for improvement. Engaging with financial metrics in this way not only fosters informed decision-making but also paves the way for sustainable growth in a competitive marketplace. By leveraging a profit margin calculator, small business owners can advance confidently toward their business goals, turning insights into actionable strategies.