- Understanding the Minimum Payment Calculator Credit Card Example: How It Works and Why It Matters

- What Is a Minimum Payment Calculator Credit Card Tool?

- How Minimum Payments Are Calculated: The Basics

- Minimum Payment Calculator Credit Card Example

- Why Using a Minimum Payment Calculator Credit Card Is Important

- The Pitfalls of Paying Only the Minimum

- Tips to Manage Your Credit Card Debt Wisely

- Conclusion

Understanding the Minimum Payment Calculator Credit Card Example: How It Works and Why It Matters

When managing credit card debt, understanding how much you need to pay each month can be confusing. This is where a minimum payment calculator credit card tool becomes incredibly useful. By using this calculator, cardholders can estimate their minimum monthly payments based on their outstanding balance, interest rates, and payment terms. This article will break down how a minimum payment calculator works, provide a real-world credit card example, and explain why relying on minimum payments may not always be the best financial strategy.

What Is a Minimum Payment Calculator Credit Card Tool?

A minimum payment calculator credit card helps cardholders figure out the smallest amount they have to pay on their credit card each month to remain in good standing with their bank or credit card issuer. The minimum payment is generally:

- A small percentage of the outstanding balance (usually between 1% to 3%)

- Plus any accrued interest and fees

This calculator uses these parameters, along with your current balance and interest rate, to show a projected minimum payment amount. It’s a valuable tool for budgeting and planning debt repayments, especially during tight financial times.

How Minimum Payments Are Calculated: The Basics

Credit card issuers typically calculate the minimum payment using one of the following methods:

- Percentage of the balance: For example, 2% of your total outstanding balance.

- Flat fee plus interest: A lower flat minimum like $25, plus interest charges and past due amounts.

- Larger of the two: Some issuers charge the greater of the percentage or flat fee.

The minimum payment calculator credit card takes these rules into account. For example, if your credit card balance is $5,000 with an interest rate of 18%, the calculator will estimate the minimum amount you must pay each month to avoid penalties.

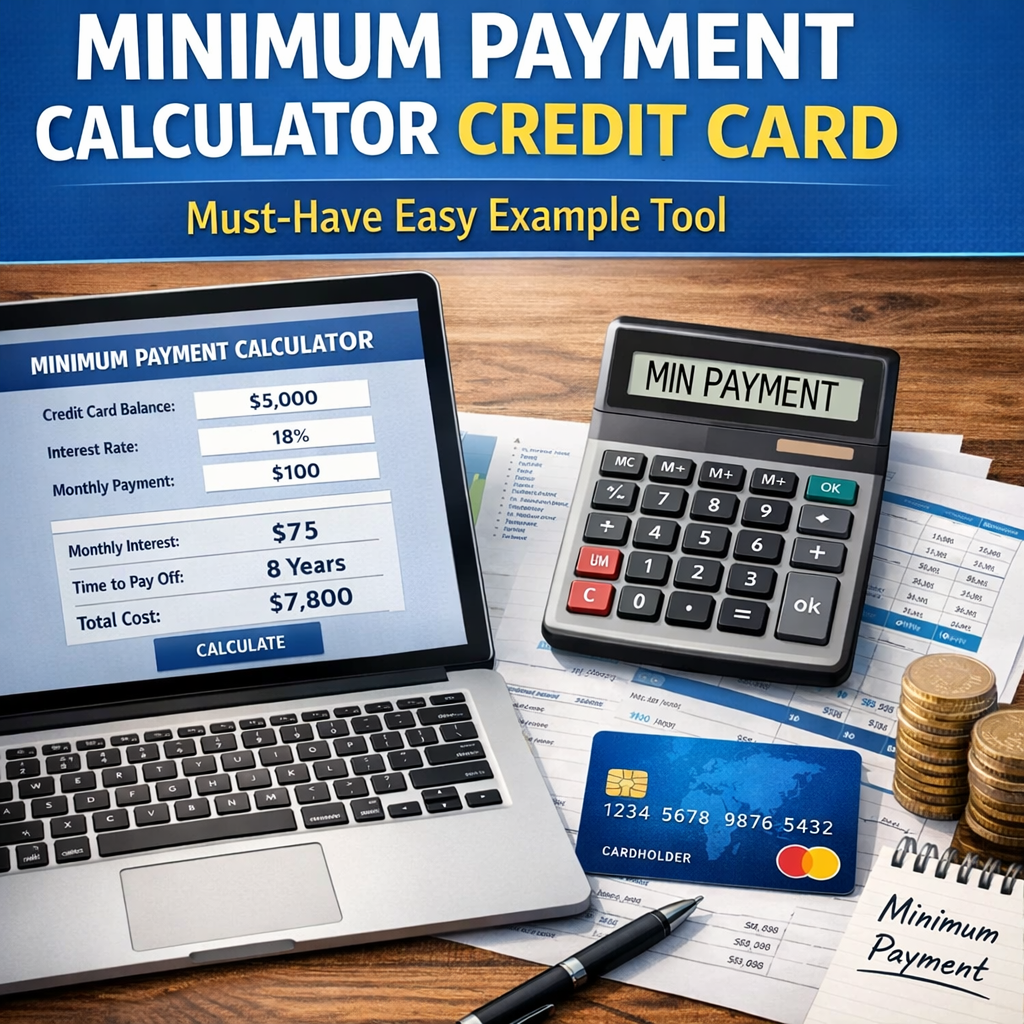

Minimum Payment Calculator Credit Card Example

Let’s demonstrate with a practical example:

- Balance: $5,000

- Interest Rate: 18% APR (Annual Percentage Rate)

- Minimum Payment Percentage: 3% of the balance or $25, whichever is greater

First, calculate the monthly interest:

- Convert APR to monthly interest rate: 18% ÷ 12 = 1.5%

- Interest for this month: $5,000 × 1.5% = $75

Next, calculate 3% of the balance:

$5,000 × 3% = $150

Now, determine the minimum payment, which is generally the sum of the monthly interest and a small portion of the principal. In many cases, credit card agreements state you must pay either the flat fee or a percentage of the total balance, including accrued interest. In this example, your minimum payment would be $150, since it is higher than the flat $25 minimum.

Using a minimum payment calculator credit card in this scenario would instantly give you this figure and even show how your balance will reduce if you only make minimum payments or if you decide to pay extra towards the principal.

Why Using a Minimum Payment Calculator Credit Card Is Important

Understanding the minimum payment is crucial for several reasons:

- Avoiding penalties and fees: Making at least the minimum payment on time prevents late fees and damage to your credit score.

- Planning your budgeting: Knowing the minimum amount helps you budget your finances more effectively.

- Visualizing debt repayment timelines: Many calculators project how long it will take to repay your balance if you only pay the minimum, revealing the impact of interest accumulation over time.

- Encouraging better repayment habits: Seeing those timelines and total costs motivates users to pay more than the minimum to reduce debt faster and save on interest.

The Pitfalls of Paying Only the Minimum

While the minimum payment keeps your account in good standing, it’s helpful to realize why paying only this amount has downsides:

- Interest accumulates: Since minimum payments mostly cover interest and a tiny bit of principal, the balance decreases very slowly.

- Longer repayment period: It may take years or even decades to clear the debt.

- Higher total cost: You pay much more in interest than if you paid down your balance faster.

Using the minimum payment calculator credit card tool, you can run “what-if” scenarios to understand how much longer your debt will last—and how much extra money you can save by increasing your monthly payments.

Tips to Manage Your Credit Card Debt Wisely

- Pay more than the minimum: Even an extra $50 monthly can significantly reduce your debt term.

- Use calculators often: Regularly check your minimum payment and explore different payment amounts.

- Avoid new debt: Don’t accumulate more charges while working on repayment.

- Seek lower interest rates: Consider balance transfers or negotiating with your issuer.

Conclusion

A minimum payment calculator credit card example like the one presented helps demystify how minimum monthly payments are computed and why they matter. It’s a helpful starting point for anyone juggling credit card debt, enabling smarter decisions and more effective planning. While minimum payments are important to keep your account healthy, aiming to pay more will save money and shorten your debt journey. Utilizing calculators and tools to understand your specific numbers can empower you on your path to financial freedom.