- What is a Leverage Calculator and Why Does It Matter?

- Leverage Calculator Trading Example: Breaking It Down

- Scenario:

- Step 1: Input the values into the leverage calculator:

- Step 2: Calculate Margin Required

- Step 3: Assess Potential Exposure

- Step 4: Understand the Risks

- Why Use a Leverage Calculator in Your Trading?

- Best Practices When Trading with Leverage

- 1. Always Use a Stop-Loss

- 2. Avoid Maximum Leverage

- 3. Continuously Monitor Your Margin Levels

- 4. Use a Leverage Calculator as Part of Your Trading Routine

- Conclusion

Understanding a Leverage Calculator Trading Example: How to Maximize Your Trading Power Safely

In the fast-paced world of financial markets, leverage calculator trading example is an essential tool for both novice and experienced traders looking to amplify their market exposure while managing risk effectively. Leverage allows traders to control large positions with a relatively small amount of capital, but without proper understanding, it can also magnify losses. This article will guide you through a practical example using a leverage calculator, helping you grasp how leverage works and how to use it responsibly in your trading strategy.

What is a Leverage Calculator and Why Does It Matter?

Before diving into the example, it’s important to understand what a leverage calculator does. A leverage calculator helps traders determine the amount of money they can control with their available capital when using leverage. It also clarifies how much margin (the trader’s own money) is required to open a particular position.

By inputting variables such as account balance, leverage ratio, and position size, the calculator outputs crucial figures like margin required and potential exposure. This insight aids in better risk management, as traders can visualize the effects of leverage before entering trades.

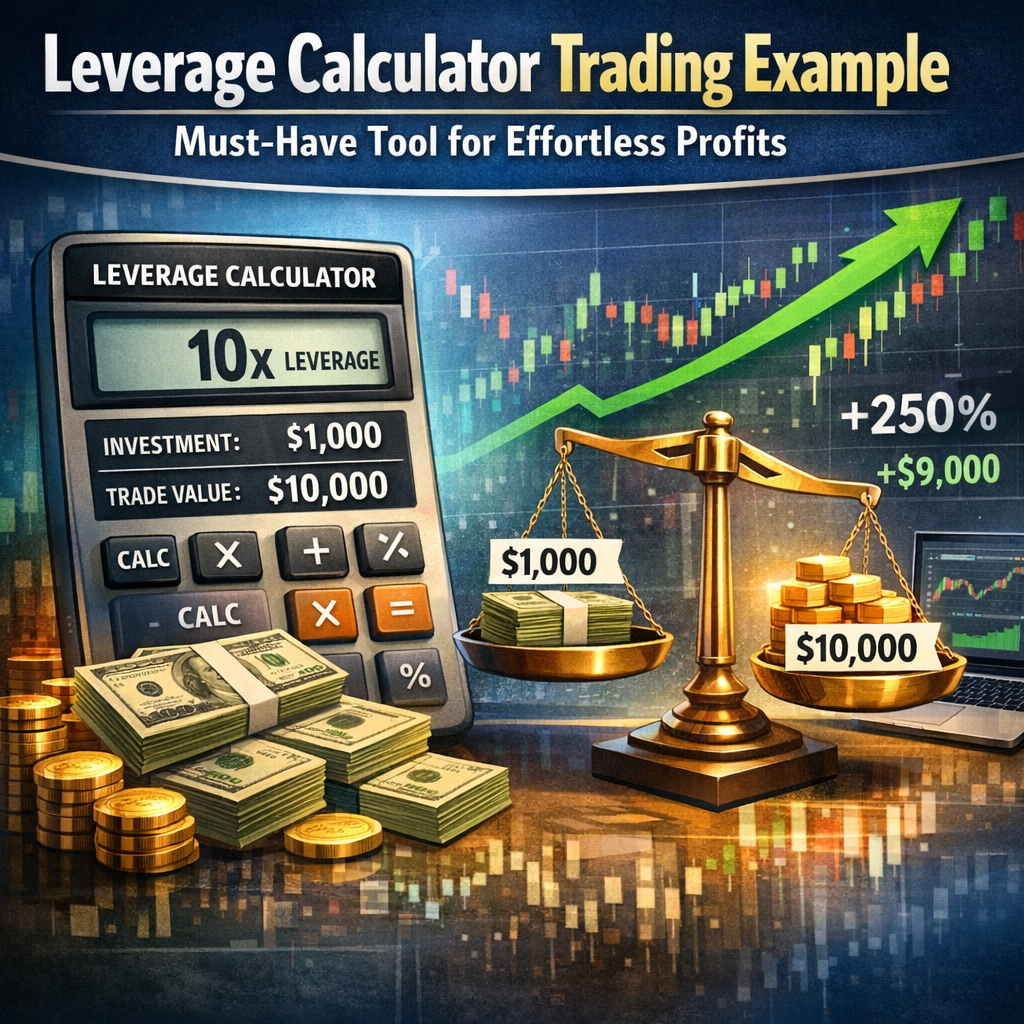

Leverage Calculator Trading Example: Breaking It Down

Let’s consider a practical example to see how a leverage calculator works in real trading:

Scenario:

- You have an account balance of $1,000.

- You want to trade a position size of 10,000 units (in Forex, this is a mini lot).

- The maximum leverage available is 1:50.

Step 1: Input the values into the leverage calculator:

- Account balance: $1,000

- Leverage: 50:1

- Position size: 10,000 units

Step 2: Calculate Margin Required

Using leverage of 50:1 means you only need 1/50th of the position size to open the trade.

- Calculation:

Margin required = Position size / Leverage

= 10,000 units / 50

= 200 units worth of currency (or $200 if trading USD pairs)

Step 3: Assess Potential Exposure

Your total exposure in the market is $10,000, but your actual invested capital (margin) is only $200. This allows you to control a much larger position than your real capital, maximizing potential gains.

Step 4: Understand the Risks

While the potential for profit is large, losses are magnified as well. If the market goes against you by just 2%, that translates into a $200 loss, wiping out your margin and potentially putting your account at risk of a margin call.

Why Use a Leverage Calculator in Your Trading?

The leverage calculator trading example highlights critical insights that help traders:

- Manage risk effectively: Knowing the exact amount of margin required prevents over-leveraging, which can quickly drain an account.

- Plan position sizing: By accurately calculating margin, traders can plan how many lots they can afford to trade while preserving enough capital for other trades or to buffer against losses.

- Evaluate different leverage options: The calculator makes it simple to experiment with different leverage levels to see their impact on required margin and risk.

Best Practices When Trading with Leverage

Leverage can be a double-edged sword. To harness its power without jeopardizing your capital, keep these best practices in mind:

1. Always Use a Stop-Loss

This ensures that your losses are limited to an acceptable level if the market moves against your position.

2. Avoid Maximum Leverage

Even though brokers may offer high leverage like 100:1 or more, using the maximum available leverage increases risk exponentially. A conservative approach with lower leverage is safer.

3. Continuously Monitor Your Margin Levels

Keep an eye on margin usage and account balance so you don’t end up with a margin call, which can force the broker to close your positions automatically.

4. Use a Leverage Calculator as Part of Your Trading Routine

Make it a habit to check margin requirements before opening any trade. This reduces impulsive decisions and supports disciplined trading.

Conclusion

The leverage calculator trading example clearly shows how leverage can amplify your buying power, allowing control of larger positions with limited capital. However, the potential for larger profits comes paired with greater risks. By using a leverage calculator diligently, traders can maintain better control over their trades, optimize position sizes, and, most importantly, protect their accounts from excessive losses. Whether you are new to trading or seeking to improve your strategy, incorporating leverage calculators into your risk management toolkit is a smart, essential step toward trading success.