- What is GST?

- What Does Inclusive and Exclusive Mean in GST?

- Using a GST Calculator Inclusive Exclusive Example

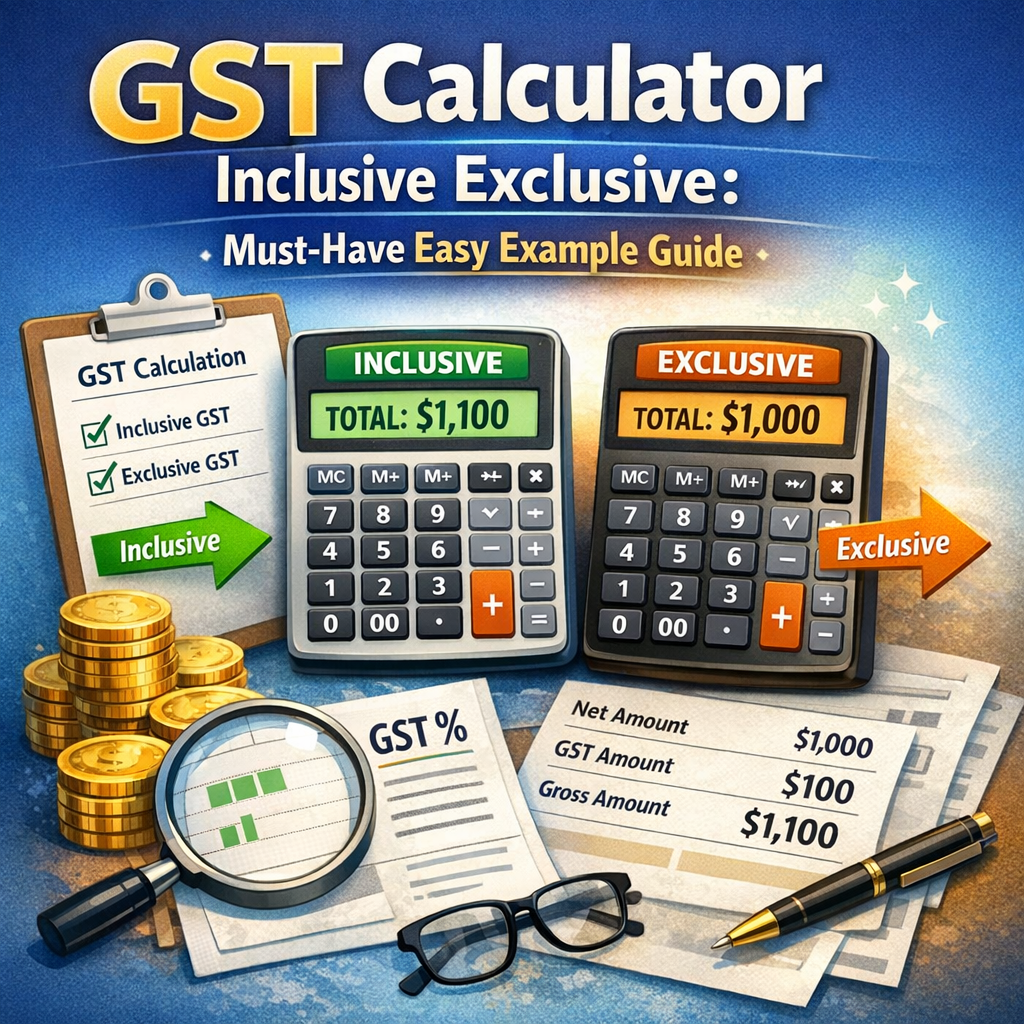

- Example 1: Calculating GST Exclusive Price from Inclusive Price

- Example 2: Calculating GST Inclusive Price from Exclusive Price

- Why Use a GST Calculator?

- Tips for Businesses Using GST Calculators

- Conclusion

Understanding GST Calculator Inclusive Exclusive Example: A Comprehensive Guide

If you’re running a business or planning to make purchases in a country where Goods and Services Tax (GST) is applicable, understanding how to calculate GST is essential. A GST calculator inclusive exclusive example can help clarify how GST is applied to prices, whether it’s included in the listed price or added on top of it. This knowledge is crucial for both businesses and consumers to ensure accurate pricing, billing, and financial management.

In this article, we will explore the concept of GST calculation, what it means for prices to be inclusive or exclusive of GST, and walk through practical examples using a GST calculator. By the end, you’ll have a clear understanding of the mechanics and practical use of GST calculators in day-to-day transactions.

What is GST?

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services. It has replaced many indirect taxes in several countries with a single unified tax system. GST can either be charged as an inclusive price (where the price already includes GST) or exclusively (where GST is added on top of the base price).

What Does Inclusive and Exclusive Mean in GST?

Understanding the difference between inclusive and exclusive GST pricing is crucial:

-

GST Inclusive Price: This means the price displayed or quoted already includes the GST amount. In other words, the GST is embedded within the total price. If you buy a product listed at $118 including 18% GST, the GST is already calculated inside this $118 price.

-

GST Exclusive Price: This means the price displayed or quoted does not include GST. GST is added on top of the base price at the applicable rate. For example, if a product’s base price is $100 exclusive of 18% GST, the GST added ($18) will make the total payable amount $118.

To avoid confusion and errors, businesses often use GST calculators to quickly determine the final price payable or to extract the base price from a GST-inclusive figure.

Using a GST Calculator Inclusive Exclusive Example

A GST calculator inclusive exclusive is a handy tool that simplifies GST calculations by automating the conversion between inclusive and exclusive prices. Let’s explore how to use it with practical examples.

Example 1: Calculating GST Exclusive Price from Inclusive Price

Imagine you have a product price of $118, inclusive of an 18% GST rate. You want to find out the base price (exclusive of GST) and the GST amount included.

Calculation:

- GST Rate = 18%

- Price inclusive of GST = $118

To find the base price (exclusive GST):

Base Price = Inclusive Price / (1 + GST Rate)

Base Price = 118 / (1 + 0.18)

Base Price = 118 / 1.18 = $100

GST Amount = Inclusive Price – Base Price

GST Amount = 118 – 100 = $18

So, the base price is $100 and GST is $18 on the total $118 price.

Example 2: Calculating GST Inclusive Price from Exclusive Price

Suppose the product’s base price is $100, and you need to find out the final price including 18% GST.

Calculation:

- GST Rate = 18%

- Base Price = $100

GST Amount = Base Price × GST Rate

GST Amount = 100 × 0.18 = $18

Total Price Inclusive of GST = Base Price + GST Amount

Total Price = 100 + 18 = $118

This confirms that the product price including GST is $118.

Why Use a GST Calculator?

Manually calculating GST can sometimes lead to mistakes, especially when dealing with multiple items and various GST rates. Here’s why a GST calculator is beneficial:

- Accuracy: Automatically calculates the correct GST amount and verifies the totals.

- Time-Saving: Reduces time spent on calculations and increases efficiency.

- Versatile Pricing: Helps convert between GST-inclusive and exclusive pricing with ease.

- Financial Transparency: Ensures transparent billing for businesses and customers alike.

Tips for Businesses Using GST Calculators

- Always confirm the applicable GST rate for your product or service. Different products might have different tax slabs.

- Clearly indicate whether your prices are inclusive or exclusive of GST to avoid customer confusion.

- Use GST calculator tools online or mobile apps designed specifically for your country’s GST regime.

- Regularly update your calculator to match any tax rate changes by government authorities.

Conclusion

A GST calculator inclusive exclusive example is an important resource that simplifies understanding GST pricing structures. Whether you want to extract the base price from an inclusive GST price or calculate the total amount from an exclusive base price, a GST calculator can speed up the process and prevent errors. By mastering these calculations, businesses can ensure compliance with tax regulations, and customers can confidently understand the prices they pay.

Next time you deal with GST, remember these simple calculations or use reliable GST calculator tools to make your financial transactions smoother and more accurate.