- Fixed vs Variable Mortgage Calculator Comparison: Making the Right Choice for Your Home Loan

- Understanding Fixed vs Variable Mortgages

- Why Use a Fixed vs Variable Mortgage Calculator?

- Key Features of Fixed vs Variable Mortgage Calculators

- How to Use a Fixed vs Variable Mortgage Calculator Effectively

- Pros and Cons: Insights from the Calculator Comparison

- Real-Life Scenario: Using the Calculator for Better Decisions

- Final Thoughts on Fixed vs Variable Mortgage Calculator Comparison

Fixed vs Variable Mortgage Calculator Comparison: Making the Right Choice for Your Home Loan

When deciding between a fixed or variable mortgage, understanding how the payments could change over time is crucial. A fixed vs variable mortgage calculator offers a powerful way to compare lender options, helping homebuyers and homeowners forecast their financial commitments and make informed decisions.

Understanding Fixed vs Variable Mortgages

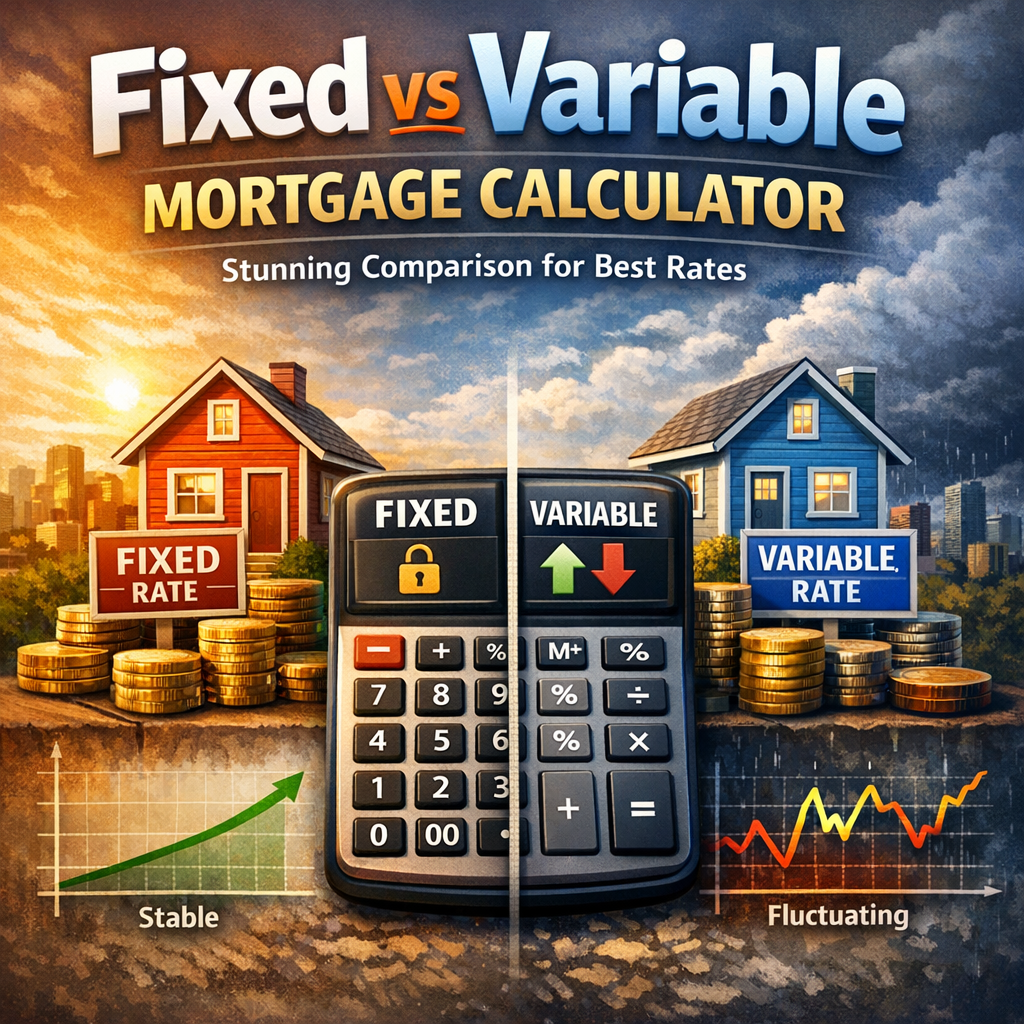

Before diving into the calculator comparison, it’s helpful to clarify what fixed and variable mortgages entail. A fixed mortgage has an interest rate that remains the same throughout the loan term, providing predictable monthly payments. Conversely, a variable mortgage has an interest rate that fluctuates based on market conditions or an underlying benchmark rate, which can lead to changing monthly payments either upwards or downwards.

Why Use a Fixed vs Variable Mortgage Calculator?

Choosing between fixed and variable mortgage rates can be complicated without numbers to back your decision. This is where a fixed vs variable mortgage calculator comes into play. By inputting loan amounts, interest rates, and terms, these calculators can show you how your monthly payments and total interest cost might differ under each option. This forward-looking insight can save you money and reduce uncertainty during your home loan journey.

Key Features of Fixed vs Variable Mortgage Calculators

-

Payment Projections Over Time: The calculator provides a detailed payment schedule based on your input. For fixed mortgages, the monthly payment remains constant. For variable mortgages, the calculator may simulate interest rate changes based on user assumptions or historical trends.

-

Interest Cost Comparison: It calculates the total interest paid over the loan’s lifespan, highlighting how rate fluctuations on variable mortgages can impact overall cost.

-

User-Friendly Interface: Most calculators feature intuitive design with input fields for loan size, term length, initial interest rate, and possible rate adjustments.

-

Scenario Analysis: Some advanced calculators allow users to test different scenarios, such as rising interest rates, helping you understand worst-case and best-case outcomes.

How to Use a Fixed vs Variable Mortgage Calculator Effectively

To maximize the benefit, start by gathering accurate information from your lender or loan documents. Enter the principal amount, loan term, and current interest rates. For variable mortgages, input assumptions or ranges for how much the rate might adjust over time.

Pay close attention to these results:

- Monthly Payment Amounts: Determine if you prefer the certainty of a fixed payment or are comfortable with variability.

- Total Interest Paid: Assess long-term affordability.

- Payment Fluctuation Range: Understand potential payment increases and assess your risk tolerance.

Pros and Cons: Insights from the Calculator Comparison

The fixed vs variable mortgage calculator highlights the trade-offs clearly.

Fixed Mortgage Pros:

- Stability in budgeting since payments don’t change

- Protection against rising interest rates

- Easier financial planning for the long term

Fixed Mortgage Cons:

- Generally higher initial interest rates

- Potential for missing out on savings if rates drop

Variable Mortgage Pros:

- Typically lower initial rates

- Potential savings if rates stay steady or decline

- Flexibility to benefit from market rate changes

Variable Mortgage Cons:

- Payment uncertainty can complicate budgeting

- Risk of significant payment increases if rates rise sharply

Real-Life Scenario: Using the Calculator for Better Decisions

Imagine you’re borrowing $300,000 over 25 years. Your fixed rate is 4.5%, while your variable rate starts at 3.8% but could increase by 0.5% annually.

Using the calculator:

- Fixed rate payment remains approximately $1,667 per month.

- Variable mortgage might start as low as $1,552 but by year 5, if rates rise as expected, payments might hit $1,750 or more.

This side-by-side comparison allows you to visualize the risk and reward, guiding your choice based on personal finances and risk appetite.

Final Thoughts on Fixed vs Variable Mortgage Calculator Comparison

Selecting the right mortgage type affects your financial stability and the total cost of your home. A fixed vs variable mortgage calculator provides clarity, cutting through jargon to deliver a transparent view of how each option impacts your payments over time. By leveraging these tools, you can confidently choose a mortgage plan tailored to your budget, goals, and tolerance for risk—turning what was once a complex decision into a manageable one.

Before finalizing your mortgage, consult with financial advisors and lenders, use online calculators for multiple scenarios, and carefully evaluate your financial situation to ensure your mortgage aligns with your long-term plans.