- What is an EMI and Why Use an EMI Calculator?

- How to Use an EMI Calculator for a 30 Lakh Home Loan

- EMI Calculator 30 Lakh Home Loan Example Breakdown

- What Does This Mean for You?

- Factors Affecting Your EMI on a 30 Lakh Home Loan

- Benefits of Using an EMI Calculator for Your Home Loan

- Final Thoughts

EMI Calculator for 30 Lakh Home Loan Example: Understanding Your Monthly Payments

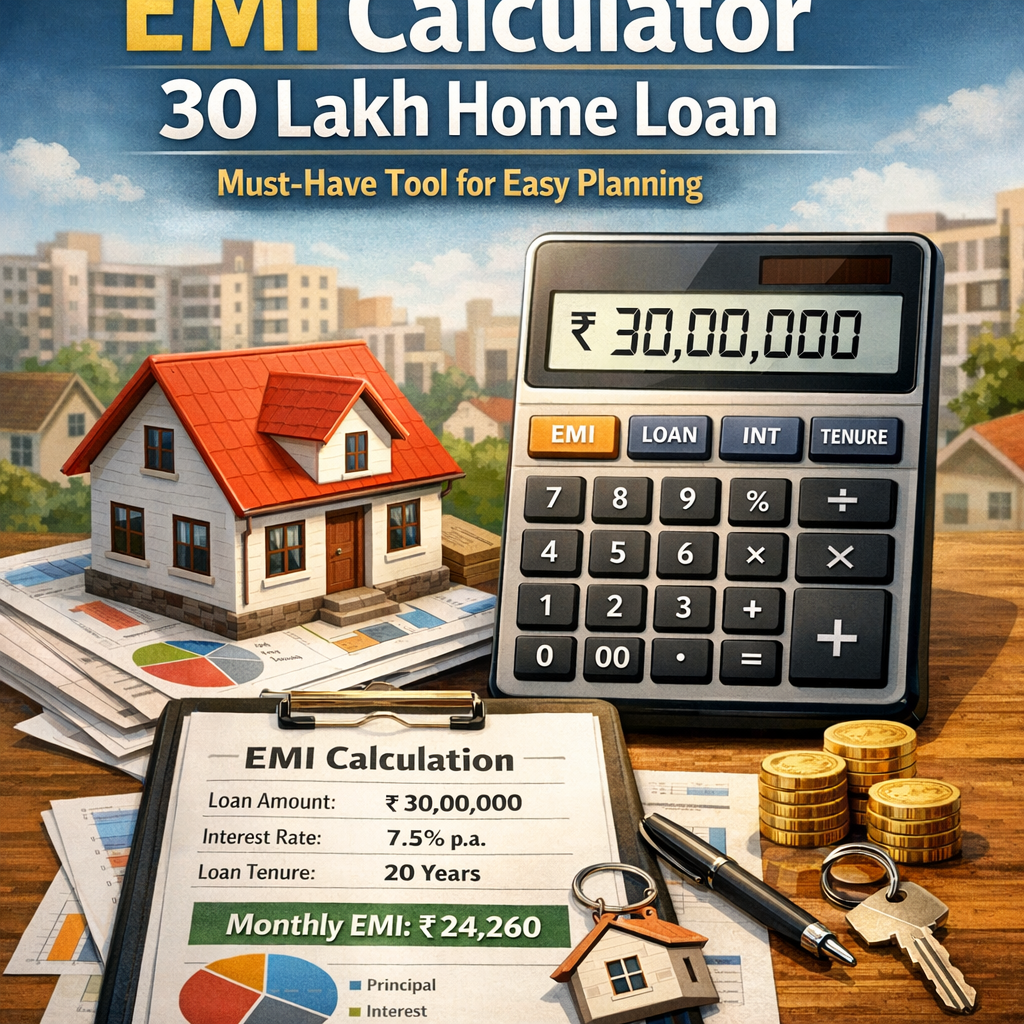

When considering a significant investment like purchasing a home, understanding your monthly financial commitments is crucial. An EMI calculator 30 lakh home loan example can provide valuable insight into how much you would need to pay each month, helping you plan your budget effectively. This tool simplifies the often complex process of loan repayment calculation, allowing borrowers to visualize their liabilities before committing to a loan.

What is an EMI and Why Use an EMI Calculator?

EMI stands for Equated Monthly Installment, which is the fixed amount a borrower pays every month to the lender until the home loan is fully repaid. This amount covers both the principal and interest components of the loan. The EMI amount depends on several factors, including the loan amount, interest rate, and loan tenure.

An EMI calculator 30 lakh home loan is a valuable tool for anyone considering a home loan in the range of ₹30,00,000. By inputting different interest rates and tenure options, borrowers can estimate the monthly payment amount, aiding them in making informed decisions without having to manually calculate complex formulas.

How to Use an EMI Calculator for a 30 Lakh Home Loan

Using an EMI calculator is straightforward and user-friendly. Here’s a step-by-step guide to calculate your monthly EMI for a 30 lakh home loan:

- Enter the Loan Amount: Start by entering ₹30,00,000 as the loan amount.

- Input the Interest Rate: Input the applicable annual interest rate offered by your lender (for example, 8.5% per annum).

- Select Loan Tenure: Choose the repayment period—this could typically range from 5 to 30 years.

- Calculate EMI: Upon entering these details, the calculator instantly computes your monthly EMI.

This simple process takes seconds and provides a clear picture of your monthly financial obligation.

EMI Calculator 30 Lakh Home Loan Example Breakdown

To better understand how the EMI is calculated, let’s consider a practical example.

- Loan Amount: ₹30,00,000

- Interest Rate: 8.5% per annum (fixed or floating depending on lender)

- Loan Tenure: 20 years

Using the EMI formula or an online EMI calculator, the monthly payment can be calculated as follows:

[ EMI = frac{P times r times (1 + r)^n}{(1 + r)^n – 1} ]

Where:

- (P) = Principal loan amount = ₹30,00,000

- (r) = Monthly interest rate = Annual interest rate / 12 / 100 = 8.5 / 12 / 100 = 0.00708

- (n) = Loan tenure in months = 20 years × 12 = 240

Plugging in the numbers, the approximate EMI works out to around ₹25,660.

What Does This Mean for You?

This means you would need to pay ₹25,660 every month for 20 years to repay your ₹30 lakh home loan at an 8.5% interest rate. Understanding this amount before applying for the loan helps you assess your financial capacity and make any necessary adjustments to your budget.

Factors Affecting Your EMI on a 30 Lakh Home Loan

While the EMI calculator provides a helpful estimate, it’s essential to remember that the actual EMI might vary due to:

- Interest Rate Changes: If you opt for a floating interest rate, fluctuations can increase or decrease your EMI.

- Loan Tenure Adjustments: Choosing a shorter tenure increases your EMI, while a longer tenure reduces it but increases total interest paid.

- Processing Fees and Other Charges: Some lenders include processing fees or other charges, which might affect your monthly repayment indirectly.

- Prepayment Options: Making prepayments can reduce your principal amount, thus lowering future EMIs.

Using an EMI calculator allows you to explore these scenarios by altering the inputs and seeing how your monthly liability changes.

Benefits of Using an EMI Calculator for Your Home Loan

- Time-Saving and Convenient: No need for manual calculations or financial expertise; just input your parameters and get results instantly.

- Comparison Tool: Comparing EMIs from different lenders becomes easier, enabling you to pick the best option.

- Financial Planning: Knowing your EMI upfront helps you maintain transparency in your monthly budgeting.

- Prepares You for Future Payments: You can simulate various scenarios by changing interest rates or tenures to understand how things might change.

Final Thoughts

An EMI calculator 30 lakh home loan example is an indispensable tool for homebuyers looking to manage their finances better. It provides clarity on monthly payment obligations, helping borrowers make informed decisions with confidence. Whether you’re a first-time buyer or looking to refinance your home loan, using an EMI calculator can save you time, effort, and potential financial stress by offering a clear projection of your repayment commitments.

Take advantage of this simple yet powerful tool to ensure that your home loan journey is smooth, manageable, and aligned with your financial goals.