- What Is a Debt Payoff Planner?

- Why Interest Matters in Debt Payoff

- How a Debt Payoff Planner Interest Example Works

- Benefits of Using a Debt Payoff Planner

- Visual Clarity

- Motivation and Accountability

- Optimized Payment Strategies

- Financial Awareness

- How to Choose the Right Debt Payoff Planner

- Tips for Making the Most of Your Debt Payoff Planner

- Conclusion

How a Debt Payoff Planner with Interest Example Can Help You Manage Your Finances

When it comes to managing personal finances, one of the biggest challenges many people face is paying off debt. A debt payoff planner interest example can be an invaluable tool to help you understand how interest affects your debt and how different strategies can save you money and time. By breaking down complex calculations into an easy-to-follow plan, you can take control of your financial future with confidence.

What Is a Debt Payoff Planner?

A debt payoff planner is a structured tool or system that assists you in organizing all your outstanding debts, tracking payments, and visualizing how long it will take to become debt-free. It often includes important factors such as interest rates, minimum payments, and payment schedules. By inputting your debt information, you get a clear picture of your financial obligations and a realistic path to paying them off.

Why Interest Matters in Debt Payoff

Interest is the additional amount you pay on top of the principal balance of your debt. It’s what lenders charge for the convenience of borrowing money. While the principle amount is the original debt, the interest accumulates over time and can significantly increase the total cost of your debt.

Using a debt payoff planner interest example helps illustrate just how much interest you will pay if you only make minimum payments versus an accelerated repayment plan. This understanding motivates many people to take a more aggressive approach to minimize interest and save money in the long run.

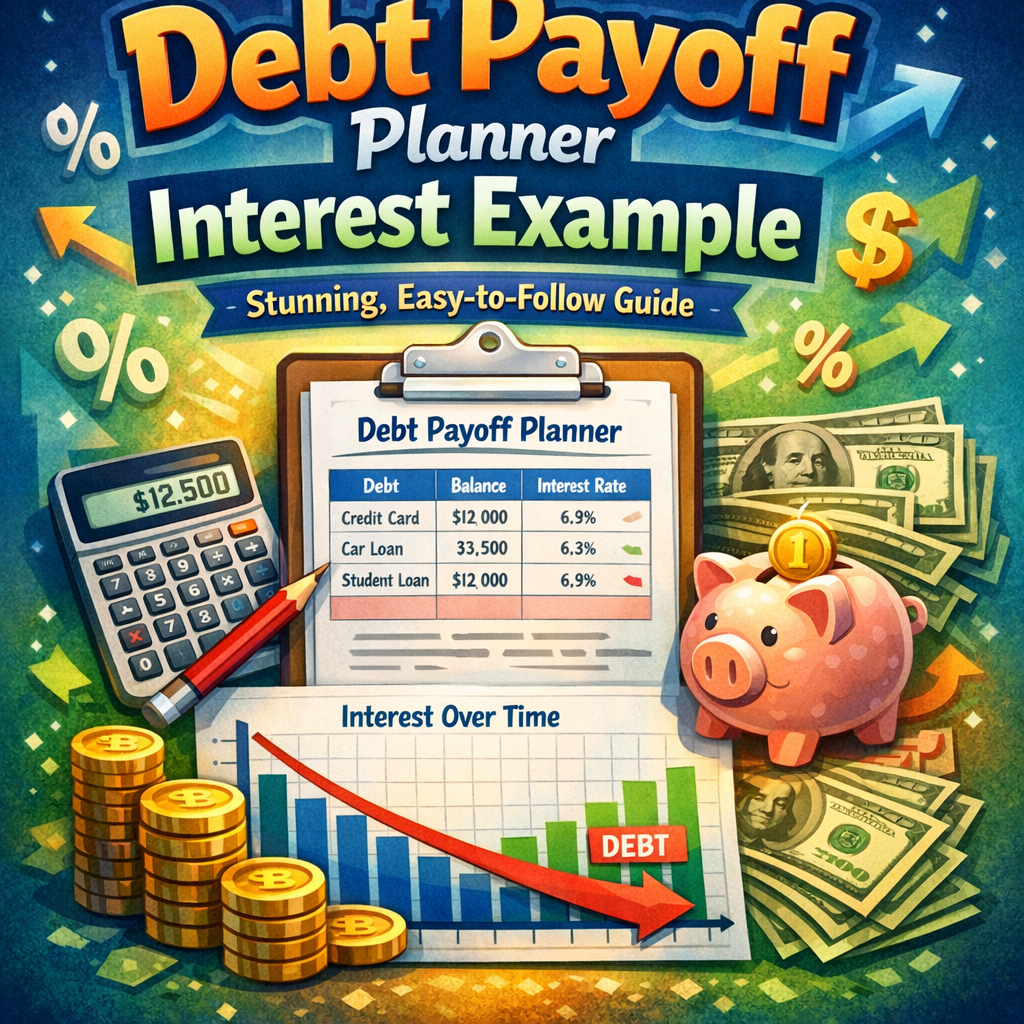

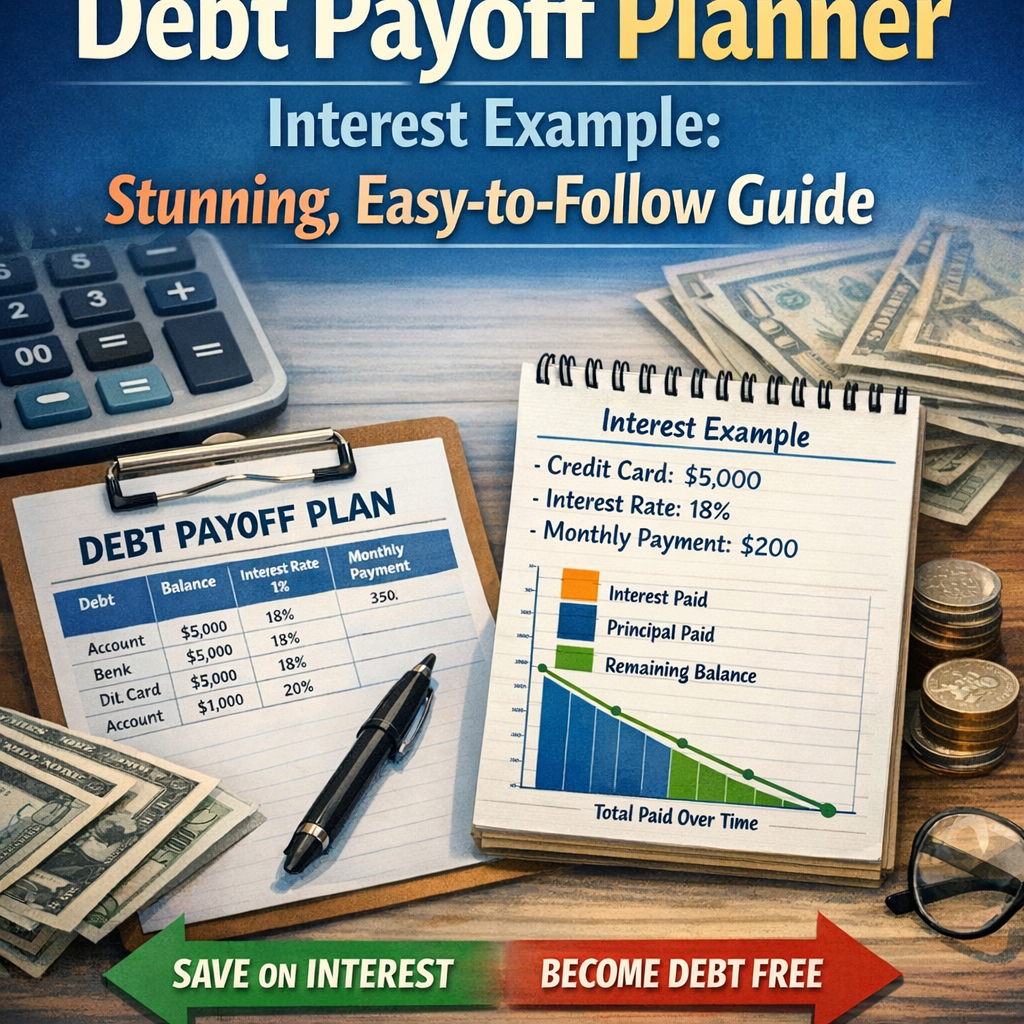

How a Debt Payoff Planner Interest Example Works

Let’s consider a practical example to see how a debt payoff planner handles interest calculations.

Suppose you have a credit card balance of $5,000 with an interest rate of 18% annually. The minimum monthly payment is $150.

- If you only pay $150 monthly, the debt payoff planner can calculate how long it will take to clear the balance and how much total interest you will pay during that period.

- If you increase your monthly payments to $300, the planner recalculates the timeline and total interest, showing how much you save by paying more each month.

Here’s a simplified breakdown:

| Payment per Month | Months to Pay Off | Total Interest Paid |

|---|---|---|

| $150 | 48 | $1,100 |

| $300 | 20 | $450 |

This example highlights the power of making higher payments. Not only do you get out of debt faster, but you also save a substantial amount of money on interest.

Benefits of Using a Debt Payoff Planner

Visual Clarity

Seeing your debts and payments laid out clearly reduces anxiety and confusion about what you owe. A planner summarizes all debts in one place and provides a roadmap towards becoming debt-free.

Motivation and Accountability

Tracking progress every month keeps you motivated. Watching the principal balance decline can feel rewarding and encourage continued commitment.

Optimized Payment Strategies

Some planners allow you to experiment with strategies such as the debt snowball or debt avalanche methods. These approaches prioritize which debts to pay first, based on balance or interest rates, optimizing your payoff plan.

Financial Awareness

Knowing exactly how much interest accrues helps you understand the cost of borrowing. This awareness can change behavior and reduce reliance on credit in the future.

How to Choose the Right Debt Payoff Planner

When selecting a debt payoff planner, consider:

- Interest Calculation: The planner must accurately account for interest, especially if your debts have variable rates or compound interest.

- User Interface: A simple, user-friendly design helps you stay engaged without feeling overwhelmed.

- Customization: Look for planners that let you enter multiple debts, payment dates, and amounts.

- Scenario Testing: Being able to test different payoff scenarios (e.g., extra payments, lump sums) provides insight into controlling your finances.

There are many free and paid options available online, including smartphone apps that send reminders and update your progress in real time.

Tips for Making the Most of Your Debt Payoff Planner

- List Every Debt: Include credit cards, loans, medical bills, and any other outstanding amounts.

- Keep Payment Info Updated: Record any changes to minimum payments or interest rates.

- Set Realistic Payment Amounts: Choose sustainable monthly payments that fit your budget.

- Use Extra Funds Wisely: Apply bonuses, tax refunds, or side hustle earnings toward your debts.

- Review Progress Monthly: Regular check-ins help refine your plan and stay on track.

Conclusion

Using a debt payoff planner interest example equips you with the knowledge and tools needed to manage and eliminate your debt efficiently. It breaks down interest calculations in a transparent way, making it easier to see the benefits of various payment strategies. Armed with this insight, you can make informed decisions, reduce interest costs, and ultimately achieve financial freedom. Whether you are just starting or looking to improve your current repayment plan, a debt payoff planner serves as a powerful guide on your journey to a debt-free life.