- What Is a Cash Flow Projection Calculator?

- Why Use a Cash Flow Projection Calculator?

- Exploring a Cash Flow Projection Calculator Example

- Step 1: List Cash Inflows

- Step 2: Identify Cash Outflows

- Step 3: Opening Cash Balance

- Step 4: Using the Cash Flow Projection Calculator

- Step 5: Interpretation

- Benefits Highlighted by This Example

- Tips for Creating Effective Cash Flow Projections

- Conclusion

Understanding a Cash Flow Projection Calculator Example: A Practical Guide

When managing a business or personal finances, it’s crucial to anticipate future cash inflows and outflows to maintain financial stability. A cash flow projection calculator example is an invaluable tool for this purpose. It helps users estimate their available cash over a set period by considering expected income and expenses, enabling better decision-making and financial planning. In this article, we’ll explore what a cash flow projection calculator is, how it works, and provide a detailed example to illustrate its practical application.

What Is a Cash Flow Projection Calculator?

A cash flow projection calculator is a financial tool used to forecast the movement of money in and out of an entity—whether a business or individual—over a specific timeframe. Unlike simple budgeting that focuses on income versus expenses, cash flow projections provide a timeline of when money will be received and paid out. This insight helps prevent cash shortages, plan for investments, and prepare for unexpected costs.

Using such a calculator, users input estimated revenues, operational costs, loan repayments, and other cash activities. The output outlines anticipated cash positions for each period, such as weekly, monthly, or quarterly intervals.

Why Use a Cash Flow Projection Calculator?

Cash flow projection calculators are essential for several reasons:

- Financial Planning: Knowing when cash will be tight allows businesses to arrange short-term financing or delay certain expenses.

- Investment Decisions: Positive cash flow forecasts can justify new investments or expansion plans.

- Avoiding Insolvency: It helps identify periods of negative cash flow that might threaten the business’s survival.

- Budgeting Accuracy: Provides a dynamic cash management approach beyond static budgets.

- Investor Confidence: Demonstrates control over finances to potential investors or lenders.

Exploring a Cash Flow Projection Calculator Example

To better understand how this tool operates, let’s consider a straightforward example involving a small retail business projecting cash flow over the next three months.

Step 1: List Cash Inflows

- Sales Revenue: The business expects $20,000 in January, $25,000 in February, and $22,000 in March.

- Loan Proceeds: A $5,000 loan disbursement expected in February.

- Other Receipts: $1,000 miscellaneous income in March.

Step 2: Identify Cash Outflows

- Inventory Purchases: $10,000 in January, $12,000 in February, and $11,000 in March.

- Salaries and Wages: A consistent payment of $5,500 each month.

- Rent Payment: $2,000 per month.

- Loan Repayment: $500 monthly starting March.

- Utilities and Miscellaneous Expenses: $1,000 per month.

Step 3: Opening Cash Balance

Assuming the business starts with $8,000 cash on hand in January.

Step 4: Using the Cash Flow Projection Calculator

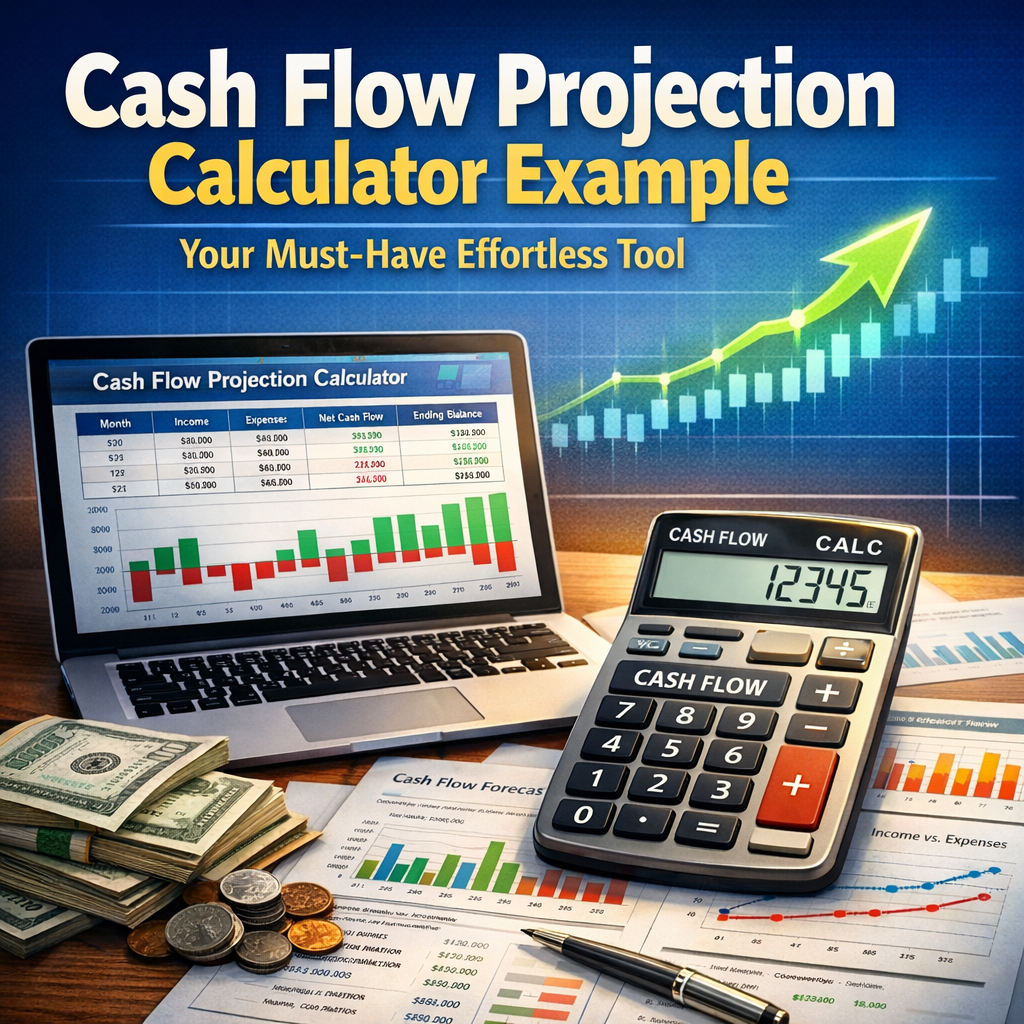

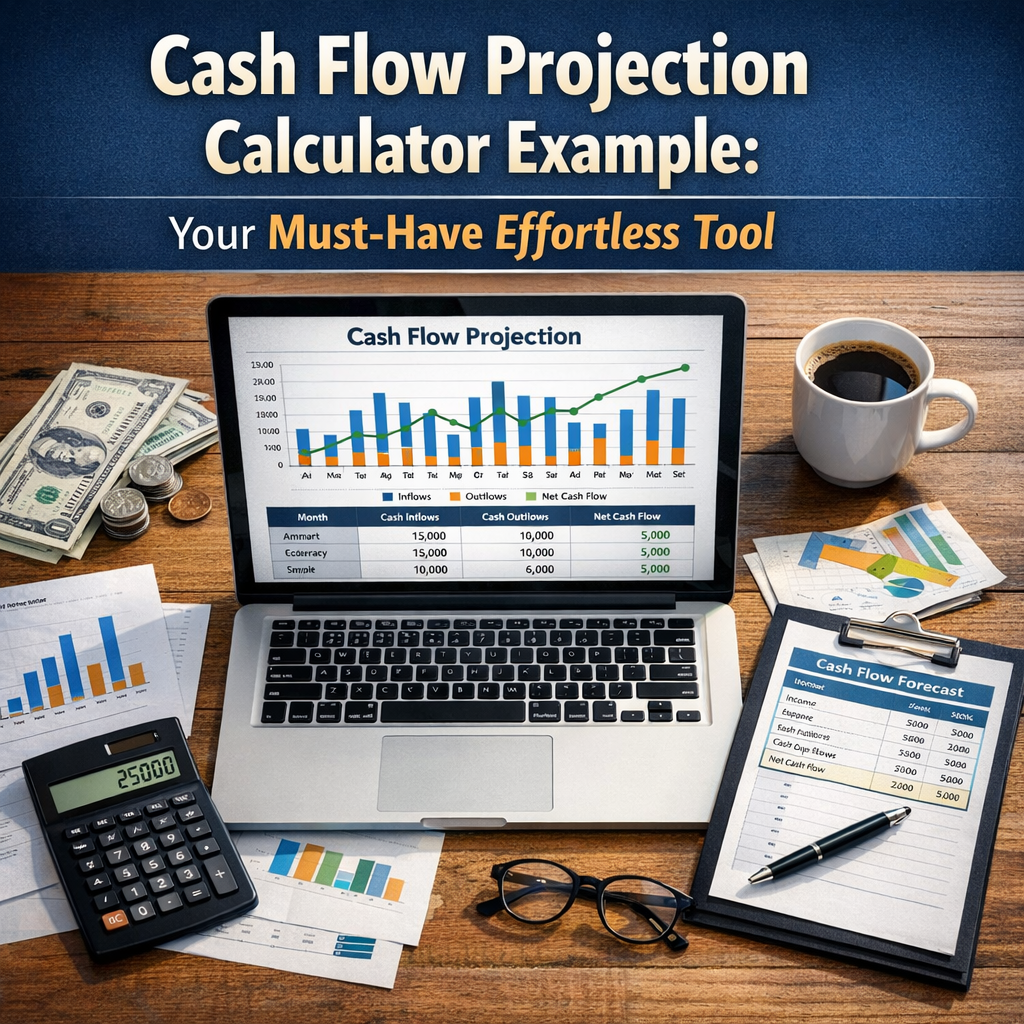

The calculator tallies each month’s cash inflows and outflows, adding the net amount to the opening balance to produce ending cash balance:

| Month | Opening Cash | Inflows | Outflows | Net Cash Flow | Ending Cash Balance |

|---|---|---|---|---|---|

| January | $8,000 | $20,000 | $18,500 | $1,500 | $9,500 |

| February | $9,500 | $30,000 | $19,500 | $10,500 | $20,000 |

| March | $20,000 | $23,000 | $20,000 | $3,000 | $23,000 |

Step 5: Interpretation

The projection indicates a positive cash flow each month with increasing ending cash balances, suggesting the business can comfortably cover its expenses and loan repayments within this timeframe.

Benefits Highlighted by This Example

This simple projection emphasizes the usefulness of a cash flow projection calculator example:

- The business owner gains visibility into when cash peaks and dips.

- Awareness of loan repayments helps avoid missed payments.

- It supports decisions about potential additional spending or investments, knowing surplus cash is available.

Tips for Creating Effective Cash Flow Projections

- Be Conservative: Overestimate expenses and underestimate revenues for a buffer.

- Update Regularly: Revise projections with actual figures and changing circumstances.

- Include Seasonal Variations: Reflect sales fluctuations throughout the year.

- Factor in Payment Terms: Recognize that sales on credit don’t immediately turn into cash.

- Consider Unexpected Costs: Allocate a contingency fund for emergencies.

Conclusion

A cash flow projection calculator example is not just a theoretical exercise but a practical way to manage financial health proactively. Whether running a small business or handling personal finances, using this tool to anticipate cash positions enhances planning and helps avoid financial pitfalls. By inputting realistic data and updating projections regularly, users can steer their financial journey toward stability and growth confidently. If you haven’t yet explored cash flow projections, now is an excellent time to start incorporating them into your financial routine.