- Understanding Business Valuation Calculator DCF Example: A Practical Guide

- What is a Business Valuation Calculator Using DCF?

- Why Use a Business Valuation Calculator DCF Example?

- Key Components of a DCF Business Valuation

- Business Valuation Calculator DCF Example Walkthrough

- Benefits and Limitations of Using a Business Valuation Calculator DCF Example

- Conclusion

Understanding Business Valuation Calculator DCF Example: A Practical Guide

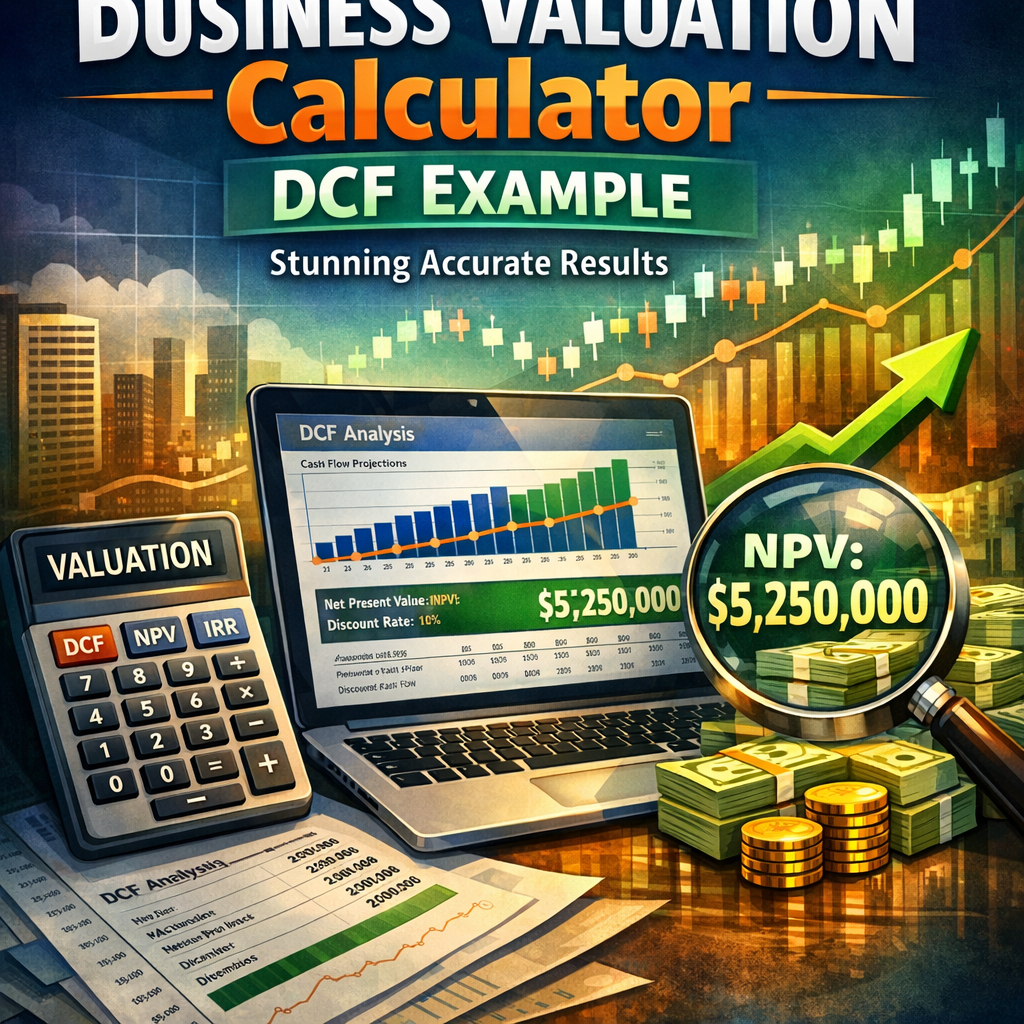

When it comes to determining the value of a company, one of the most trusted methods used by professionals is the Discounted Cash Flow (DCF) analysis. The business valuation calculator DCF example offers a practical way to estimate a company’s intrinsic value based on its expected future cash flows, discounted back to their present value. This article will walk you through what a business valuation calculator using the DCF method entails, how it works, and provide a simple example to help you grasp the concept more clearly.

What is a Business Valuation Calculator Using DCF?

A business valuation calculator that applies the Discounted Cash Flow method is a tool designed to estimate the current worth of a business by projecting its future cash flows and then discounting them using a rate reflective of the investment risk. This method is prized because it looks beyond simple earnings or revenues, focusing instead on the fundamentals of cash generation potential.

The DCF method assumes that the true value of a business is equivalent to the total value of all the money the business will generate in the future, adjusted for the time value of money (TVM). Time value of money acknowledges that a dollar today is worth more than a dollar in the future due to its earning potential.

Why Use a Business Valuation Calculator DCF Example?

For business owners, investors, or financial analysts, understanding how to use a DCF calculator is incredibly valuable because it provides a more nuanced valuation than other methods like asset-based or market-based approaches. Unlike relying on market comparables alone, DCF calculations incorporate the specific financial projections and unique risks associated with the particular business.

Using a business valuation calculator DCF example also helps demystify the method, breaking down complex valuation into understandable steps.

Key Components of a DCF Business Valuation

Before diving into an example, it helps to identify the main components used in DCF calculations:

- Free Cash Flow (FCF): The cash a business generates after accounting for cash outflows to support operations and maintain capital assets.

- Projection Period: The number of years into the future that you forecast cash flows, often 5 to 10 years.

- Discount Rate: Often the weighted average cost of capital (WACC), which reflects the risk of the investment.

- Terminal Value: The estimated value of the business at the end of the projection period, accounting for all future cash flows beyond the projection.

- Present Value: The value today of all projected cash flows and terminal value after discounting.

Business Valuation Calculator DCF Example Walkthrough

Let’s go through a straightforward example to see how a DCF calculator works in practice.

Step 1: Project Free Cash Flows

Suppose you are evaluating a small business, which you estimate will generate the following free cash flows:

| Year | Free Cash Flow (FCF) |

|---|---|

| 1 | $100,000 |

| 2 | $110,000 |

| 3 | $120,000 |

| 4 | $130,000 |

| 5 | $140,000 |

Step 2: Determine the Discount Rate

Assuming a discount rate of 10%, reflecting the company’s cost of capital and investment risk.

Step 3: Calculate the Terminal Value

At the end of year 5, estimate a terminal growth rate (long-term growth rate) of 3%. The terminal value (TV) at year 5 would be calculated using the Gordon Growth Model:

[

text{Terminal Value} = frac{text{FCF in Year 5} times (1 + g)}{r – g} = frac{140,000 times 1.03}{0.10 – 0.03} = frac{144,200}{0.07} = 2,060,000

]

Where:

- (g = 3%) terminal growth rate

- (r = 10%) discount rate

Step 4: Discount the Cash Flows and Terminal Value to Present Value

Now, discount each year’s cash flows back to the present:

[

PV = sum_{t=1}^5 frac{FCF_t}{(1+r)^t} + frac{TV}{(1+r)^5}

]

Calculate:

| Year | FCF | PV Factor (10%) | Discounted FCF |

|---|---|---|---|

| 1 | $100,000 | 0.909 | $90,900 |

| 2 | $110,000 | 0.826 | $90,860 |

| 3 | $120,000 | 0.751 | $90,120 |

| 4 | $130,000 | 0.683 | $88,790 |

| 5 | $140,000 | 0.621 | $86,940 |

| 5 (TV) | $2,060,000 | 0.621 | $1,279,260 |

Sum of discounted FCF = $90,900 + $90,860 + $90,120 + $88,790 + $86,940 = $447,610

Discounted terminal value = $1,279,260

Total enterprise value = $447,610 + $1,279,260 = $1,726,870

This value, approximately $1.73 million, represents the estimated intrinsic value of the business based on the DCF method.

Benefits and Limitations of Using a Business Valuation Calculator DCF Example

Using a business valuation calculator DCF example like this one offers invaluable insight, but there are some important limitations to consider.

Benefits:

- Highly customizable to specific business circumstances.

- Emphasizes cash generation and profitability.

- Incorporates growth prospects and risk quantitatively.

Limitations:

- Requires accurate projections, which may be difficult to obtain.

- Sensitive to assumptions about discount rate and terminal growth.

- Can be complex for those without financial background.

Conclusion

Understanding how to use a business valuation calculator with a DCF example is essential for anyone interested in valuing a business accurately. By focusing on future cash flows and adjusting for risk, the DCF method offers a rigorous and logical approach to business valuation. Whether you’re a business owner preparing to sell, an investor eyeing an acquisition, or a financial analyst conducting due diligence, mastering this approach will provide a solid foundation for informed decision-making.

Using the simple example outlined above, you can start experimenting with DCF calculations to better understand your company’s or target’s prospective value—turning abstract numbers into actionable insights.