- What Is an EMI and Why Use an EMI Calculator?

- How Does an EMI Calculator Work?

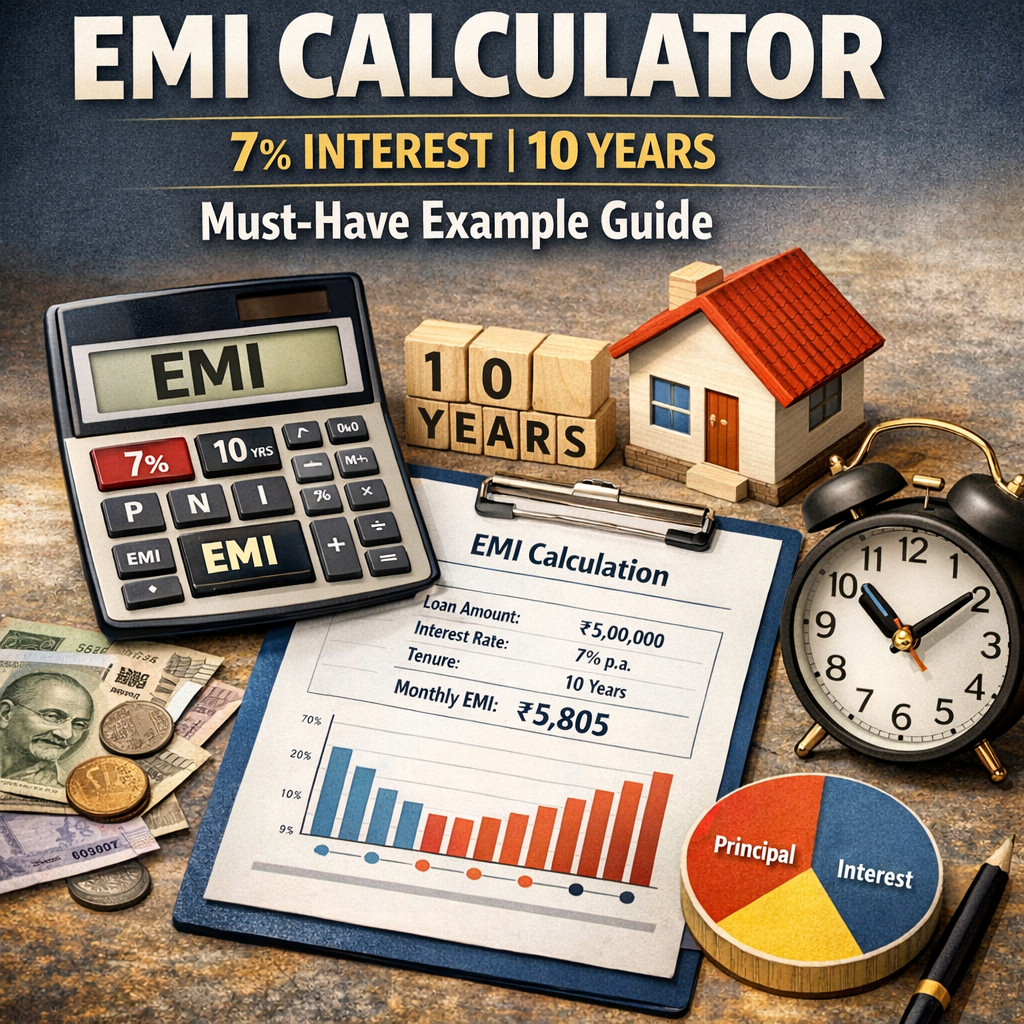

- EMI Calculator 7 Percent Interest 10 Years: An Example

- Step 1: Define the inputs

- Step 2: Calculate Monthly Interest Rate

- Step 3: Calculate Number of Installments

- Step 4: Calculate EMI

- Why the EMI Amount Matters in Loan Planning

- Benefits of Using an EMI Calculator

- How to Use an EMI Calculator Online

- Conclusion

Understanding EMI Calculator 7 Percent Interest 10 Years Example: A Complete Guide

When planning to take a loan, understanding how your monthly payments will be structured is crucial to managing your finances efficiently. An EMI calculator 7 percent interest 10 years example can be an invaluable tool in helping you visualize the exact payments you need to make over the loan tenure. This article will walk you through the concept of EMI (Equated Monthly Installment), delve into the calculation process using 7 percent interest over 10 years, and explain how you can use an EMI calculator to plan your finances better.

What Is an EMI and Why Use an EMI Calculator?

EMI stands for Equated Monthly Installment, which is a fixed amount a borrower has to pay every month to repay a loan within a predetermined period. The installment includes both the principal loan amount and the interest charged by the lender. EMIs are usually calculated so that you pay the same amount every month throughout the tenure of your loan, simplifying your budgeting.

Using an EMI calculator helps you understand the monthly financial commitment before you commit to a loan. It lets you adjust variables such as principal amount, tenure, and interest rate to see how these affect your monthly payments.

How Does an EMI Calculator Work?

An EMI calculator uses a standard mathematical formula to break down your loan into monthly payments, based on the principal (P), the interest rate ®, and the time period (N). The formula used is:

[

EMI = frac{P times r times (1+r)^n}{(1+r)^n – 1}

]

Where:

- (P) = Principal loan amount

- (r) = Monthly interest rate (annual interest rate divided by 12)

- (n) = Total number of monthly installments (loan tenure years multiplied by 12)

This formula ensures that your payments remain the same throughout the repayment period.

EMI Calculator 7 Percent Interest 10 Years: An Example

Let’s take a practical example to understand this better. Suppose you take a loan of ₹5,00,000 at 7% annual interest to be repaid over 10 years. Using the EMI calculator with 7 percent interest over 10 years, we can calculate the monthly installment as follows.

Step 1: Define the inputs

- Principal (P): ₹5,00,000

- Annual Interest Rate: 7%

- Tenure (N): 10 years (120 months)

Step 2: Calculate Monthly Interest Rate

[

r = frac{7}{100} div 12 = 0.00583 text{ (approx)}

]

Step 3: Calculate Number of Installments

[

n = 10 times 12 = 120

]

Step 4: Calculate EMI

[

EMI = frac{500000 times 0.00583 times (1 + 0.00583)^{120}}{(1 + 0.00583)^{120} – 1}

]

Using a calculator or an Excel spreadsheet simplifies this, resulting in:

[

EMI approx ₹5,806

]

This means you will have to pay roughly ₹5,806 every month for 10 years to repay this loan fully.

Why the EMI Amount Matters in Loan Planning

A fixed monthly payment helps you better manage your monthly budgets without worrying about fluctuating amounts. An EMI calculator with 7 percent interest over 10 years allows you to evaluate whether the monthly payments fit comfortably within your income and expenses. If the EMI seems too high, you can adjust variables such as loan amount or tenure to find a more manageable option.

Benefits of Using an EMI Calculator

- Quick Estimation: Instantly know how much you will have to pay monthly without manual calculations.

- Better Budgeting: You can plan your income and expenditure based on the repayments.

- Comparing Loans: Evaluate different offers by changing interest rates and tenure to find the best deal.

- Transparency: Understand how interest and principal components evolve over time.

How to Use an EMI Calculator Online

Most banks and financial websites offer free online EMI calculators. To use one for the specific 7 percent interest, 10-year example, simply enter the loan amount, interest rate (7%), and tenure (10 years). The calculator will instantly show your monthly EMI along with the total interest payable over the period.

You can experiment by changing any factor such as increasing the loan amount or shortening the tenure, to see how your EMI is affected.

Conclusion

An EMI calculator 7 percent interest 10 years example not only clarifies the amount you need to pay monthly but helps streamline your entire loan repayment planning. By using this financial tool, borrowers can avoid surprises, control budgets precisely, and select loans that suit their financial capabilities. Whether you are applying for a home loan, personal loan, or any other credit facility, understanding your EMIs upfront makes you better prepared to make informed financial decisions.

By mastering the concept of EMI and leveraging calculators for your specific interest rates and tenure, you take a confident step toward financial well-being and stability.