- Understanding Break Even Analysis Calculator Example: A Practical Guide

- What is Break Even Analysis?

- Key Components Used in Break Even Analysis

- Break Even Analysis Calculator Example: Step-by-Step

- Scenario

- Step 1: Calculate Contribution Margin per Unit

- Step 2: Determine Break Even Point in Units

- Step 3: Calculate Break Even Sales Revenue

- Using a Break Even Analysis Calculator

- Why Use a Break Even Analysis Calculator?

- Tips for Accurate Break Even Analysis

- Conclusion

Understanding Break Even Analysis Calculator Example: A Practical Guide

A break even analysis calculator example is a valuable tool for businesses and entrepreneurs seeking to understand the financial dynamics of their venture. Break even analysis determines the point at which total revenue equals total costs, meaning there is no profit or loss. This crucial metric helps in making informed decisions about pricing, production volume, and cost management. By exploring a concrete example, the concept becomes clearer and more applicable to real-world business scenarios.

What is Break Even Analysis?

Before diving into the example, it’s important to grasp what break even analysis entails. It involves calculating the break even point (BEP), the sales volume at which total revenue covers all variable and fixed costs. This analysis assists businesses in understanding how many units they need to sell or how much revenue they need to generate to avoid losses.

Key Components Used in Break Even Analysis

To perform a break even analysis, several key elements must be considered:

- Fixed Costs: These are expenses that do not change with production volume, such as rent, salaries, and insurance.

- Variable Costs: Costs that vary directly with the level of production or sales, like raw materials or direct labor.

- Sales Price per Unit: The price at which each product or service is sold.

- Contribution Margin: The difference between sales price per unit and variable cost per unit, representing the money available to cover fixed costs.

Break Even Analysis Calculator Example: Step-by-Step

Using an online break even analysis calculator can simplify the process, but understanding the manual calculation helps in better interpreting results. Let’s consider a hypothetical scenario to illustrate this.

Scenario

Imagine you own a company that manufactures handmade candles. Here’s the financial information you have:

- Fixed Costs: $10,000 per month (rent, salaries, utilities)

- Variable Cost per Candle: $5 (wax, wick, packaging)

- Selling Price per Candle: $15

Step 1: Calculate Contribution Margin per Unit

Contribution margin per candle = Selling price – Variable cost

= $15 – $5

= $10

This means each candle sold contributes $10 toward covering fixed costs.

Step 2: Determine Break Even Point in Units

Break even point (units) = Fixed costs / Contribution margin per unit

= $10,000 / $10

= 1,000 candles

You need to sell 1,000 candles monthly to break even.

Step 3: Calculate Break Even Sales Revenue

Break even sales revenue = Break even units × Selling price per unit

= 1,000 × $15

= $15,000

At $15,000 in sales revenue, your business covers all costs without profit or loss.

Using a Break Even Analysis Calculator

While manual calculations are helpful, many prefer using an online break even analysis calculator example to quickly analyze different scenarios. These calculators allow you to enter fixed costs, variable costs, and price per unit, automatically computing the break even point and sales required.

For example:

- Input Fixed Costs: $10,000

- Input Variable Cost per Unit: $5

- Input Sales Price per Unit: $15

The calculator instantly provides the break even units (1,000) and break even revenue ($15,000), saving time and reducing errors.

Why Use a Break Even Analysis Calculator?

- Quick Decision Making: Helps businesses rapidly evaluate pricing and cost structures.

- Scenario Analysis: Enables the exploration of “what-if” scenarios by adjusting costs or price inputs.

- Risk Management: Identifies the minimum sales needed to avoid losses, critical for startups.

- Financial Planning: Supports budgeting, forecasting, and setting realistic sales targets.

Tips for Accurate Break Even Analysis

- Include All Costs: Make sure all fixed and variable expenses are accounted for to prevent underestimation.

- Update Regularly: Costs and pricing can change; perform the analysis periodically.

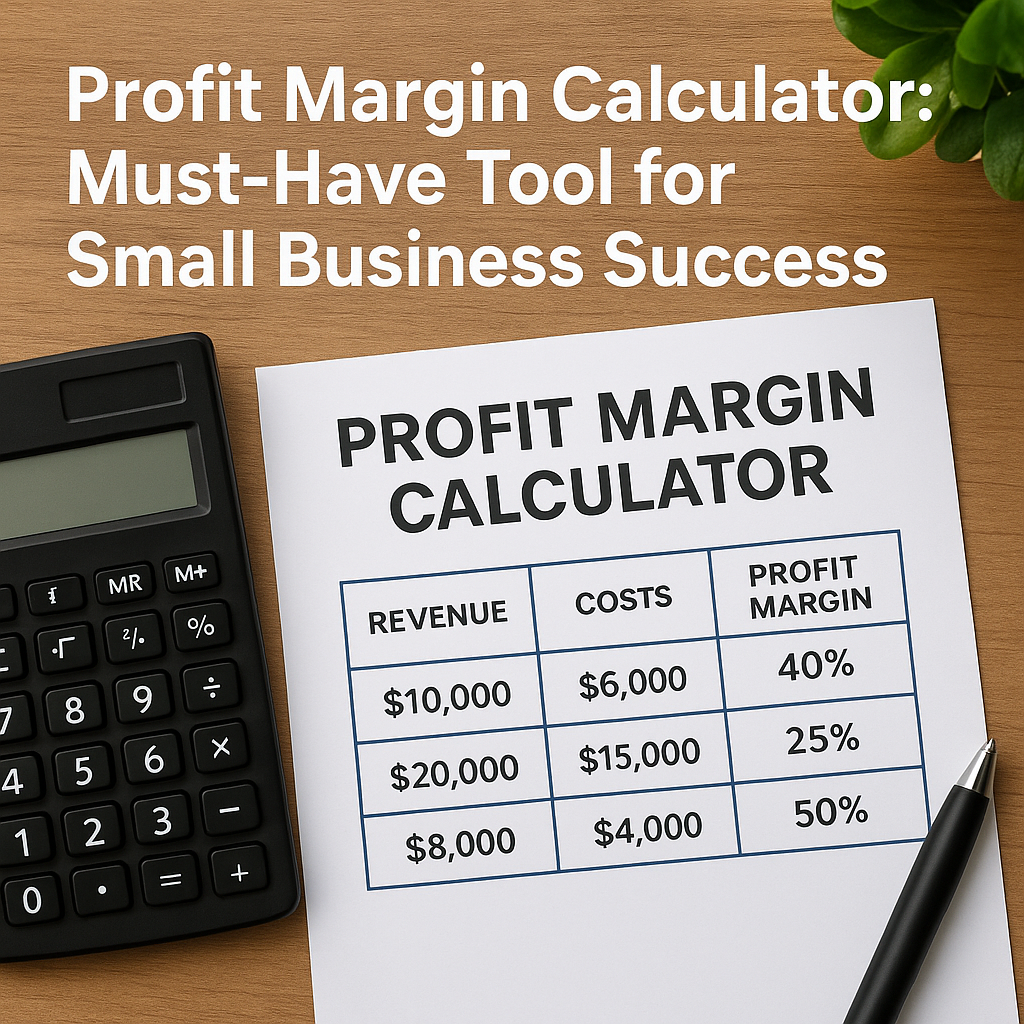

- Combine with Other Metrics: Use with profit margin and cash flow analyses for comprehensive financial evaluation.

Conclusion

A break even analysis calculator example is an invaluable asset for anyone running a business or planning a new venture. Understanding how to calculate and interpret the break even point empowers you to make strategic decisions that can greatly influence profitability and sustainability. Whether you calculate manually or use a digital tool, mastering this financial skill helps you navigate the competitive business environment with confidence and clarity.