- What is Profit Margin?

- Types of Profit Margins

- Why Use a Profit Margin Calculator?

- Components of the Profit Margin Calculator

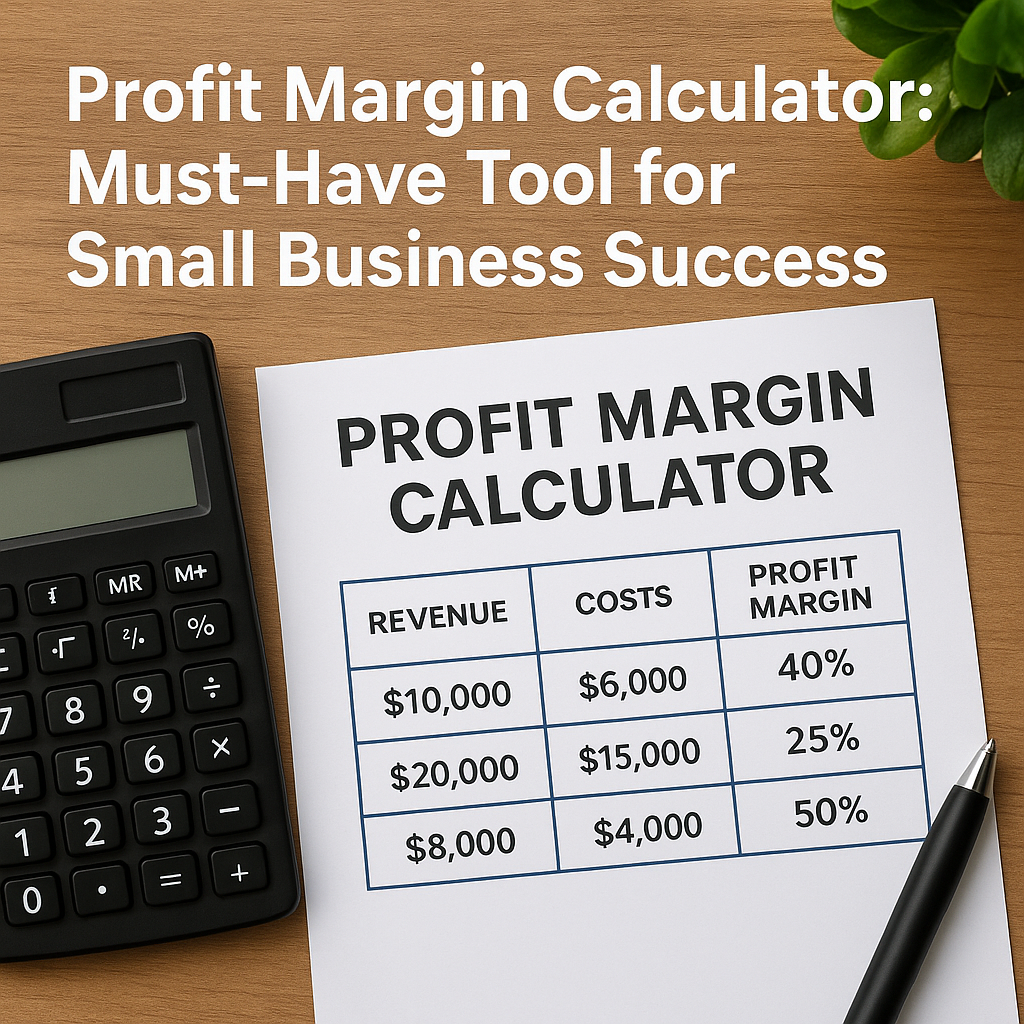

- Small Business Example: Using the Profit Margin Calculator

- Café Delight Financial Data for 2023

- Step 1: Calculate Gross Profit and Gross Profit Margin

- Step 2: Calculate Operating Profit and Operating Profit Margin

- Step 3: Calculate Net Profit and Net Profit Margin

- Interpreting the Results

- How to Use a Profit Margin Calculator in Your Small Business

- Step-by-Step Guide

- Tools and Resources for Small Business Owners

- Common Mistakes to Avoid With Profit Margin Analysis

- Conclusion

Profit Margin Calculator Small Business Example for Accurate Financial Analysis

Running a small business successfully requires more than just offering great products or services—it demands a solid understanding of financial metrics to ensure profitability and sustainable growth. Among various financial indicators, profit margin stands out as a vital metric that tells you how much profit your business makes relative to its revenue.

In this article, we will explore how a profit margin calculator can help small businesses perform accurate financial analysis. We’ll explain what profit margin is, why it matters, and walk through a practical example with a profit margin calculator tailored specifically for small businesses.

—

What is Profit Margin?

Profit margin is a financial ratio that shows the percentage of revenue that remains as profit after all expenses are deducted. It’s an important indicator of a business’s financial health, efficiency, and pricing strategy effectiveness.

Types of Profit Margins

– Gross Profit Margin: Measures profitability after subtracting the cost of goods sold (COGS) from revenue.

– Operating Profit Margin: Accounts for operating expenses as well as COGS.

– Net Profit Margin: The bottom line profit after all expenses, including taxes and interest, are deducted.

For small businesses, understanding and monitoring all three margins provides different layers of insight. However, most begin with gross profit margin and net profit margin for overall financial analysis.

—

Why Use a Profit Margin Calculator?

Calculating profit margins manually can be time-consuming and prone to errors. Using a profit margin calculator for small businesses provides:

– Accuracy: Minimize manual calculation errors.

– Speed: Get instant insights for quicker decision-making.

– Scenario Analysis: Evaluate how changes in costs, pricing, or sales volumes impact profitability.

– Financial Planning: Better budgeting, pricing, and cost management decisions.

By using a calculator, small business owners and managers can focus on interpreting results rather than crunching numbers.

—

Components of the Profit Margin Calculator

A typical profit margin calculator for small businesses requires the following inputs:

| Component | Description |

|———————|————————————————|

| Revenue (Sales) | Total income from goods or services sold. |

| Cost of Goods Sold (COGS) | Direct costs to produce the goods or services.|

| Operating Expenses | Indirect costs like rent, salaries, utilities. |

| Taxes and Interest | Other non-operational expenses. |

The calculator then computes:

– Gross Profit = Revenue – COGS

– Gross Profit Margin = (Gross Profit / Revenue) × 100%

– Operating Profit = Gross Profit – Operating Expenses

– Operating Profit Margin = (Operating Profit / Revenue) × 100%

– Net Profit = Operating Profit – Taxes and Interest

– Net Profit Margin = (Net Profit / Revenue) × 100%

—

Small Business Example: Using the Profit Margin Calculator

To demonstrate the value of a profit margin calculator, let’s apply it to a hypothetical small business example—a boutique coffee shop named Café Delight.

Café Delight Financial Data for 2023

| Category | Amount (USD) |

|———————-|————–|

| Revenue | $250,000 |

| Cost of Goods Sold | $95,000 |

| Operating Expenses | $80,000 |

| Taxes and Interest | $15,000 |

Step 1: Calculate Gross Profit and Gross Profit Margin

– Gross Profit = $250,000 – $95,000 = $155,000

– Gross Profit Margin = ($155,000 / $250,000) × 100% = 62%

This means Café Delight retains 62 cents of every revenue dollar after covering the cost of coffee beans, cups, and other direct costs.

—

Step 2: Calculate Operating Profit and Operating Profit Margin

– Operating Profit = $155,000 – $80,000 = $75,000

– Operating Profit Margin = ($75,000 / $250,000) × 100% = 30%

This indicates that after paying for rent, salaries, utilities, and marketing, the coffee shop keeps 30 cents per dollar earned.

—

Step 3: Calculate Net Profit and Net Profit Margin

– Net Profit = $75,000 – $15,000 = $60,000

– Net Profit Margin = ($60,000 / $250,000) × 100% = 24%

Café Delight’s final profit margin after taxes and interest is 24%, a healthy figure for a small business.

—

Interpreting the Results

– Gross Profit Margin (62%): This shows Café Delight’s pricing strategy and cost control for raw materials are working well.

– Operating Profit Margin (30%): Indicates reasonable management of operating costs.

– Net Profit Margin (24%): Reflects overall profitability after all expenses.

With these insights, the owner can identify where to improve:

– If Gross Margin was low, they might negotiate with suppliers.

– If Operating Margin was squeezed, they could optimize operational costs or raise prices.

– Monitoring Net Margin helps gauge overall financial health.

—

How to Use a Profit Margin Calculator in Your Small Business

Step-by-Step Guide

1. Gather Accurate Financial Data: Collect recent revenue, cost, expense, tax, and interest information.

2. Input Data: Plug those values into the profit margin calculator.

3. Analyze Results: Look at gross, operating, and net margins.

4. Compare Margins: Compare with industry benchmarks or past performance.

5. Make Adjustments: Use insights to optimize pricing, cut costs, or streamline operations.

6. Repeat Regularly: Calculate margins monthly or quarterly to track progress.

—

Tools and Resources for Small Business Owners

Several online profit margin calculators are available for free. Additionally, spreadsheet software like Excel or Google Sheets can be customized to create your own calculator. Here are some recommended resources:

– Online Profit Margin Calculators: Websites like Calculator.net or QuickBooks provide simple calculators.

– Spreadsheet Templates: Customizable templates that allow you to input your unique line items.

– Accounting Software: Tools like QuickBooks, Xero, or FreshBooks often have built-in financial reports displaying profit margins.

—

Common Mistakes to Avoid With Profit Margin Analysis

– Ignoring Variable Costs: Only focusing on fixed expenses can distort margins.

– Mixing Up Margin Types: Confusing gross margin with net margin may mislead decision-making.

– Using Outdated Data: Financial data must be current for analysis to be relevant.

– Not Benchmarking: Comparing your margins to industry averages keeps expectations realistic.

– Overlooking External Factors: Economic changes, seasonality, and competition affect profitability.

—

Conclusion

Accurate financial analysis is essential for small business success, and a profit margin calculator small business example like Café Delight’s demonstrates how simple it is to measure profitability effectively. By understanding different profit margins and leveraging a calculator, small business owners can swiftly identify strengths and weaknesses in their operations.

Regularly using a profit margin calculator empowers you to make informed decisions about pricing, cost control, and growth strategies — ultimately leading to greater financial stability and business sustainability.

Start tracking your profit margins with a calculator today and put your small business on the path to smarter financial management!