- Understanding Crypto Capital Gains Tax Calculator Example: A Practical Guide

- What Is a Crypto Capital Gains Tax Calculator?

- Why Use a Crypto Capital Gains Tax Calculator?

- Crypto Capital Gains Tax Calculator Example: Step-by-Step

- Step 1: Enter Transaction Details

- Step 2: Calculate Cost Basis

- Step 3: Calculate Sale Proceeds

- Step 4: Determine Capital Gain

- Step 5: Apply Relevant Tax Rates

- Additional Features of Crypto Capital Gains Tax Calculators

- Common Mistakes to Avoid

- Final Thoughts

Understanding Crypto Capital Gains Tax Calculator Example: A Practical Guide

Cryptocurrency has become an increasingly popular investment choice, attracting both seasoned traders and newcomers alike. However, with the rise in crypto trading, understanding the tax implications is crucial. One of the most valuable tools for investors is a crypto capital gains tax calculator example, which helps simplify the complex process of calculating taxes owed on cryptocurrency transactions. This article will explore how these calculators work, why you need them, and provide a detailed example to illustrate their practical use.

What Is a Crypto Capital Gains Tax Calculator?

A crypto capital gains tax calculator is an online tool designed to help investors determine the amount of tax they owe from trading or disposing of cryptocurrencies. Since crypto transactions are generally considered taxable events by many governments, calculating capital gains correctly is essential to comply with tax laws and avoid penalties.

Capital gains tax applies when you sell, trade, or otherwise dispose of cryptocurrency at a price higher than your purchase price. The difference between the sale price and the purchase price is your “gain,” which could be subject to tax depending on your country’s regulations.

Why Use a Crypto Capital Gains Tax Calculator?

The world of cryptocurrency can be overwhelming, especially when it comes to keeping track of multiple transactions across different exchanges and wallets. A crypto capital gains tax calculator provides several benefits:

- Accuracy: These calculators apply the correct tax rules and holding periods, reducing human error.

- Time-saving: Manual calculations can be tedious and error-prone, especially with numerous trades.

- Organized Records: Many calculators integrate blockchain data or import transaction history from exchanges.

- Compliance: Helps ensure compliance with tax authorities by providing detailed reports.

Understanding how to use these calculators through a practical example can demystify the process and increase confidence in your tax reporting.

Crypto Capital Gains Tax Calculator Example: Step-by-Step

Let’s say you bought Bitcoin (BTC) on January 1, 2023, at a price of $20,000 per BTC, and then sold half of your holdings on July 1, 2023, when the price was $30,000 per BTC. You want to calculate your capital gains tax on this transaction.

Step 1: Enter Transaction Details

Using a typical crypto capital gains tax calculator, you input the following data:

- Purchase date: January 1, 2023

- Purchase price: $20,000 (per BTC)

- Number of BTC bought: 1 BTC

- Sale date: July 1, 2023

- Sale price: $30,000 (per BTC)

- Number of BTC sold: 0.5 BTC

Step 2: Calculate Cost Basis

The cost basis is the amount you originally paid for the portion sold. Since you sold half a Bitcoin, the cost basis is:

0.5 BTC x $20,000 = $10,000

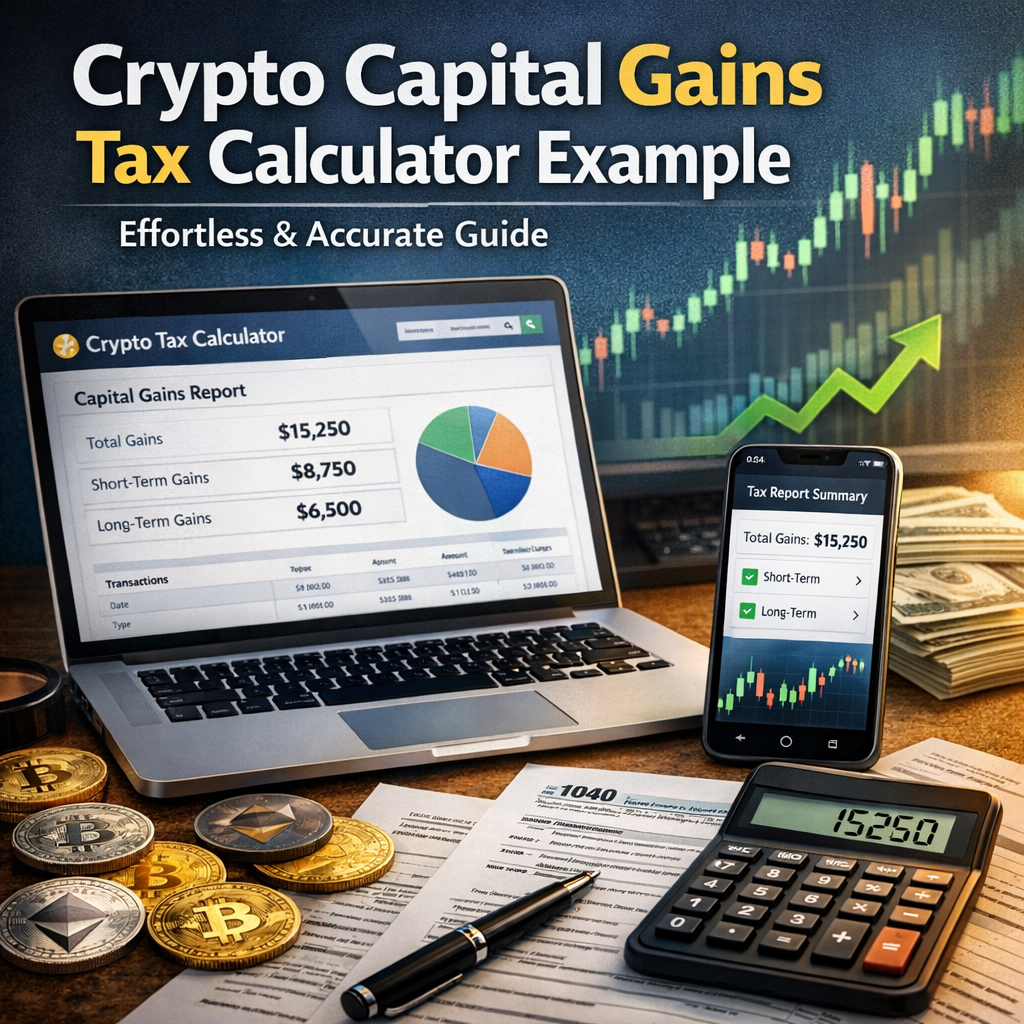

Step 3: Calculate Sale Proceeds

The sale proceeds equal the amount you received from selling 0.5 BTC at $30,000 per BTC:

0.5 BTC x $30,000 = $15,000

Step 4: Determine Capital Gain

Subtract the cost basis from the sale proceeds:

$15,000 (proceeds) – $10,000 (cost basis) = $5,000 capital gain

Step 5: Apply Relevant Tax Rates

Tax rates for capital gains vary based on how long the asset was held and your tax jurisdiction. For example, in the U.S.:

- Gains on assets held less than one year are taxed as ordinary income.

- Gains on assets held more than one year are taxed at reduced long-term capital gains rates.

Since the Bitcoin was held for six months, this gain would be considered short-term and taxed at your ordinary income tax rate.

If your tax bracket is 22%, your tax owed on this gain would be:

$5,000 x 22% = $1,100

Many calculators allow you to input your tax bracket or residency to give accurate estimates.

Additional Features of Crypto Capital Gains Tax Calculators

Modern calculators often come equipped with features that go beyond basic calculations:

- FIFO, LIFO, and Specific Identification Methods: Different ways of matching transactions which impact your tax outcome.

- Batch Import and Export: Upload CSV files from exchanges or wallets for automated calculations.

- Multiple Cryptocurrencies: Calculate gains across Bitcoin, Ethereum, altcoins, and stablecoins.

- Tax-Loss Harvesting Insights: Suggestions to reduce taxable gains by strategically selling at a loss.

Common Mistakes to Avoid

When using or interpreting a crypto capital gains tax calculator example, be wary of:

- Mixing transaction types: Mining rewards, staking, gifts, and airdrops have different tax treatments.

- Ignoring fees: Exchange fees and transaction costs can adjust your cost basis.

- Using inaccurate dates or prices: Make sure to verify historical price data.

- Not understanding local regulations: Tax laws vary widely by country and state.

Final Thoughts

A crypto capital gains tax calculator example is an essential tool for all cryptocurrency investors aiming to stay on the right side of tax authorities while maximizing their returns. By breaking down complex tax calculations into straightforward steps, these calculators provide invaluable clarity and peace of mind. Whether you’re a casual buyer or a seasoned trader, leveraging the right tax tools will help you understand your tax obligations and avoid surprises come tax season.

If you have multiple cryptocurrency transactions, consider using specialized software or consulting a tax professional to ensure accuracy and compliance. After all, effective tax planning is a key part of successful investing in the fast-evolving world of digital assets.