- Understanding the Payback Period Calculator Example: A Practical Guide

- What is a Payback Period?

- Why Use a Payback Period Calculator?

- Payback Period Calculator Example: Step-by-Step

- Scenario:

- Step 1: Input Initial Investment

- Step 2: Input Annual Cash Flows

- Step 3: Calculate Cumulative Cash Flow

- Step 4: Determine Payback Period

- Benefits of Using a Payback Period Calculator Example

- Limitations to Keep in Mind

- Tips for Using Your Payback Period Calculator Effectively

- Conclusion

Understanding the Payback Period Calculator Example: A Practical Guide

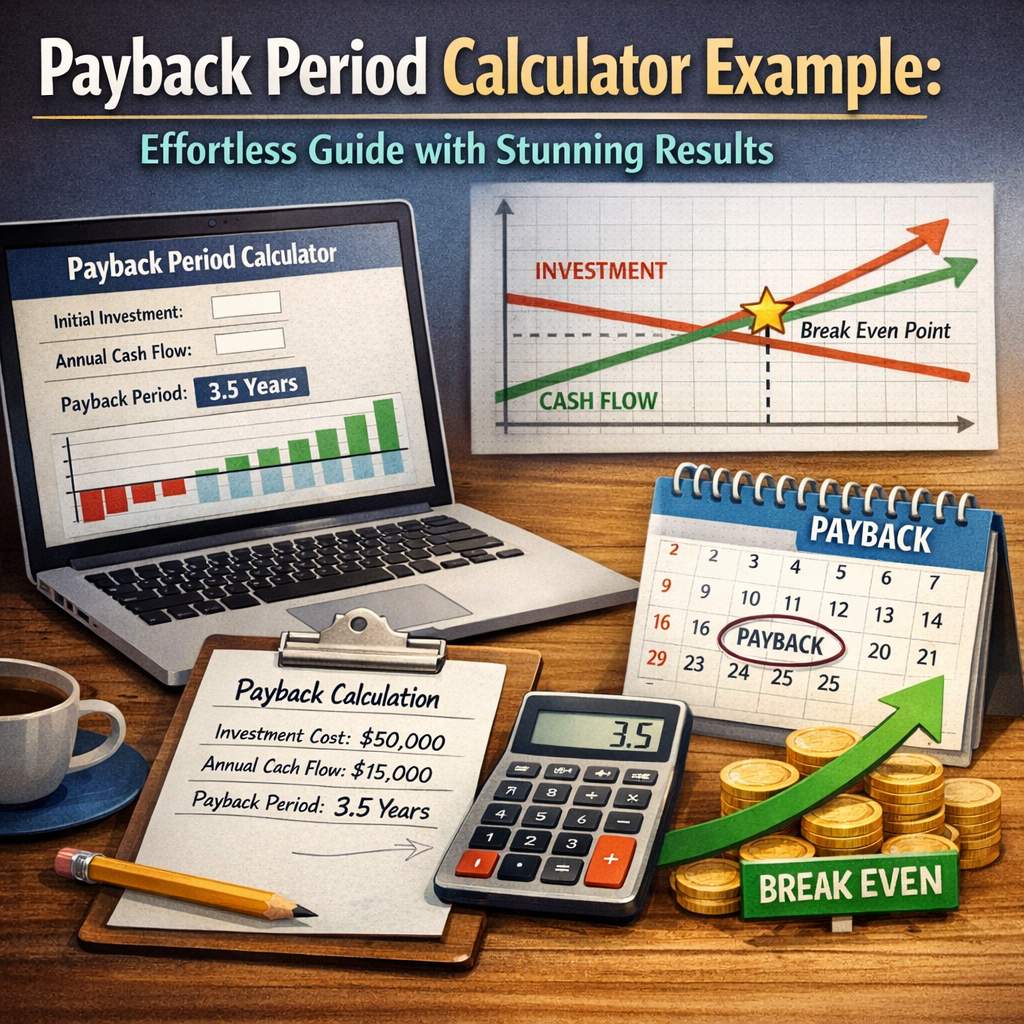

When evaluating investment opportunities, businesses and individuals alike need tools that provide clear insights into the time needed to recover an initial investment. One such powerful tool is the payback period calculator example. This financial metric helps determine how long it will take for an investment to generate cash flows sufficient to recover the original outlay. Understanding how to use and interpret this calculator can lead to better decision-making and improved financial outcomes.

What is a Payback Period?

Before diving into the payback period calculator example, it’s essential to understand what the payback period actually represents. The payback period is the length of time required for an investment to return its original cost through cash inflows. It is often used as a simple risk assessment technique in projects or investments where liquidity and cash flow are priorities.

Why Use a Payback Period Calculator?

Calculating the payback period manually can become tedious, especially when dealing with multiple cash flows over several years. This is where the payback period calculator proves invaluable. It automates the computation, making it easy to input various cash inflow values and instantly receive the payback time frame. This simplicity helps investors and managers quickly assess if the project meets their investment criteria.

Payback Period Calculator Example: Step-by-Step

To illustrate how a payback period calculator works, let’s walk through a detailed payback period calculator example.

Scenario:

Imagine a company invests $50,000 in new manufacturing equipment. The equipment is expected to generate cash inflows over the next 5 years as follows:

- Year 1: $12,000

- Year 2: $15,000

- Year 3: $13,000

- Year 4: $10,000

- Year 5: $8,000

Step 1: Input Initial Investment

The first step involves entering the initial investment amount into the calculator. In this case, it is $50,000.

Step 2: Input Annual Cash Flows

Next, input the expected cash inflows by year. For this example:

- Year 1: 12,000

- Year 2: 15,000

- Year 3: 13,000

- Year 4: 10,000

- Year 5: 8,000

Step 3: Calculate Cumulative Cash Flow

The calculator then computes the cumulative cash inflow after each year:

- End of Year 1: $12,000

- End of Year 2: $27,000 ($12,000 + $15,000)

- End of Year 3: $40,000 ($27,000 + $13,000)

- End of Year 4: $50,000 ($40,000 + $10,000)

- End of Year 5: $58,000 ($50,000 + $8,000)

Step 4: Determine Payback Period

The payback occurs when the cumulative cash flow equals the initial investment. Based on the cumulative totals, the payback is achieved between Year 3 and Year 4.

To be more precise, the amount still needed after Year 3 is $50,000 – $40,000 = $10,000. Since Year 4 generates $10,000, the payback period is exactly 3 + (10,000 / 10,000) = 4 years.

Therefore, the payback period for this investment is 4 years.

Benefits of Using a Payback Period Calculator Example

Using a payback period calculator example not only demonstrates how to find the payback period but also offers several practical benefits:

- Quick Decision-Making: It provides a fast way to analyze multiple projects and shortlist those with acceptable payback durations.

- Risk Minimization: Helps identify projects that return cash quickly, minimizing exposure to longer-term uncertainties.

- User-Friendly: Even those without advanced financial expertise can use the calculator confidently.

- Comparative Analysis: Facilitates easy comparison between investment options, giving a clear understanding of liquidity timelines.

Limitations to Keep in Mind

While the payback period provides valuable insight, it’s important to understand its limitations:

- Ignores Time Value of Money: It does not account for the present value of future cash flows, unlike discounted payback period methods.

- Cash Flows Beyond Payback: It ignores any cash flows that occur after the payback period, potentially overlooking the long-term profitability.

- No Profitability Indicator: It only measures how quickly money is recouped, not whether the project is profitable overall.

Tips for Using Your Payback Period Calculator Effectively

To get the most from your tool, consider these practical tips:

- Combine with Other Metrics: Use alongside net present value (NPV) or internal rate of return (IRR) analyses for holistic evaluation.

- Adjust for Cash Flow Timing: Be mindful that cash flows are expected at consistent intervals unless accounted for otherwise.

- Consider Inflation and Taxes: Factor in real-world adjustments to get more realistic results.

- Review Multiple Scenarios: Use the calculator to test best-case, worst-case, and average scenarios.

Conclusion

The payback period calculator example discussed here highlights the simplicity and power of this financial tool in evaluating investment recoveries. It streamlines the process of determining how long it will take to recoup an initial investment, offering clear, actionable insights. While it’s not meant to be the sole criterion for investment decisions, its ease of use and immediate feedback make it an indispensable first step in financial analysis. Whether you’re a small business owner, financial analyst, or entrepreneur, mastering the payback period calculation can enhance your investment strategy and help guide you toward smarter financial choices.