- What Is Inventory Turnover Ratio?

- Why Use an Inventory Turnover Ratio Calculator Example?

- How to Use an Inventory Turnover Ratio Calculator Example

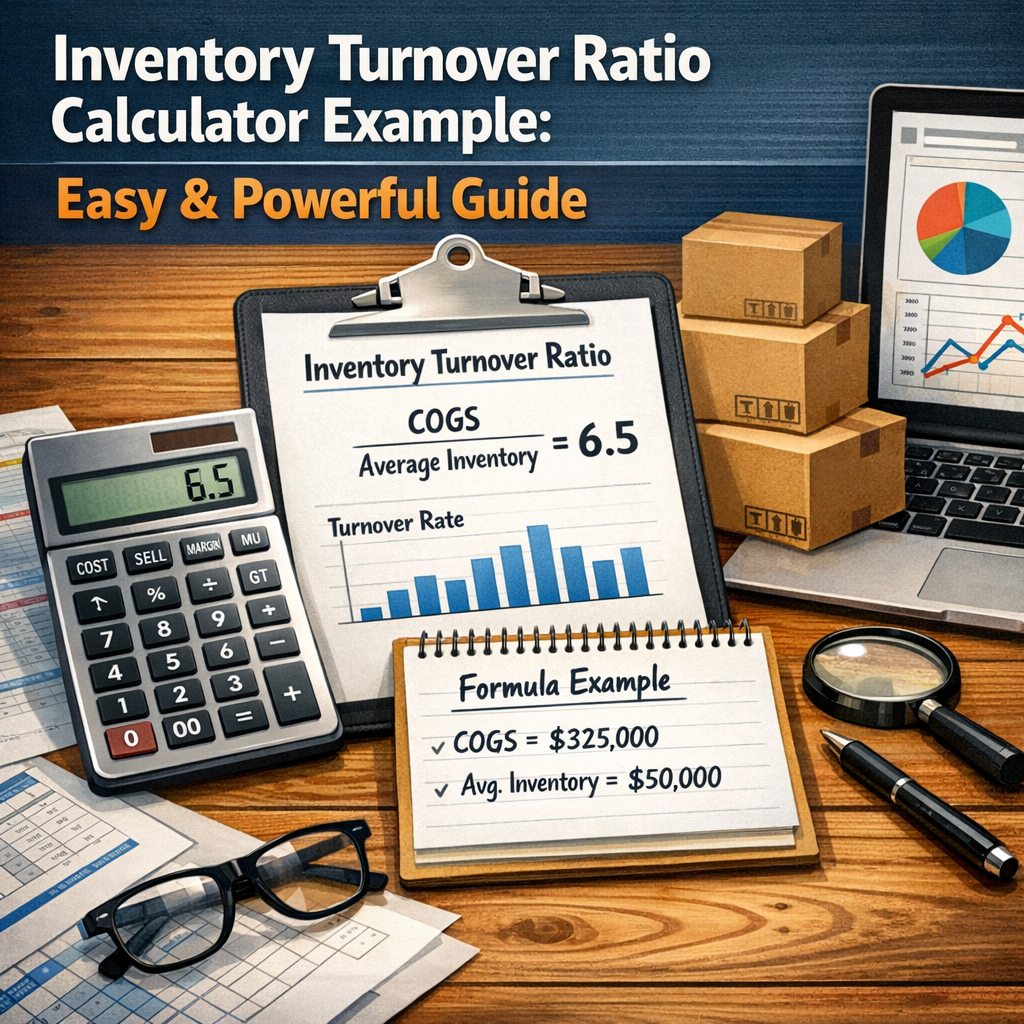

- Example Data:

- Step 1: Calculate Average Inventory

- Step 2: Use the Formula

- Step 3: Interpret the Result

- Benefits of Monitoring Inventory Turnover Ratio

- 1. Improved Cash Flow

- 2. Reduced Holding Costs

- 3. Better Purchasing Decisions

- 4. Enhanced Profitability

- Tips to Improve Your Inventory Turnover Ratio

- Conclusion

Understanding the Inventory Turnover Ratio Calculator Example: A Comprehensive Guide

If you’re looking to optimize your business’s inventory management, understanding and utilizing an inventory turnover ratio calculator example can be a game-changer. Inventory turnover is a crucial metric that helps businesses assess how efficiently their inventory is being sold and replaced over a specific period. A high turnover ratio generally indicates effective inventory management, while a low ratio can signal overstocking or slow-moving items, which ties up capital unnecessarily.

In this article, we will dive deep into what the inventory turnover ratio is, why it matters, how to calculate it using a calculator example, and practical tips to improve it.

What Is Inventory Turnover Ratio?

Inventory turnover ratio measures how many times a company’s inventory is sold and replaced during a given period, usually a year. It reflects the efficiency of inventory management and the effectiveness of sales strategies.

The basic formula for inventory turnover ratio is:

[

text{Inventory Turnover Ratio} = frac{text{Cost of Goods Sold (COGS)}}{text{Average Inventory}}

]

- Cost of Goods Sold (COGS): The direct costs attributable to the production of the goods sold in a company.

- Average Inventory: The average value of inventory held during the period (typically calculated as the average of beginning and ending inventory).

Why Use an Inventory Turnover Ratio Calculator Example?

While calculating the inventory turnover ratio manually is straightforward, using an inventory turnover ratio calculator example can simplify the process and help you understand its practical application. A calculator can:

- Provide quick results, saving you time.

- Help avoid calculation errors.

- Allow you to experiment with different data scenarios to see the effect on your turnover ratio.

- Offer a clearer understanding of how changes in inventory or sales impact overall efficiency.

How to Use an Inventory Turnover Ratio Calculator Example

Let’s walk through a practical inventory turnover ratio calculator example to illustrate the concept.

Example Data:

- Cost of Goods Sold (COGS) for the year: $500,000

- Beginning Inventory: $80,000

- Ending Inventory: $120,000

Step 1: Calculate Average Inventory

[

text{Average Inventory} = frac{text{Beginning Inventory} + text{Ending Inventory}}{2} = frac{80,000 + 120,000}{2} = 100,000

]

Step 2: Use the Formula

[

text{Inventory Turnover Ratio} = frac{500,000}{100,000} = 5

]

This means the company’s inventory turns over five times a year.

Step 3: Interpret the Result

An inventory turnover ratio of 5 suggests that the company sold and replaced its inventory five times during the year. Depending on the industry, this can be either good or average. For example:

- Retail sectors might aim for higher turnover ratios.

- Industries dealing with high-cost or slow-moving items may have lower ratios.

Using an inventory turnover ratio calculator online will automate these steps once you input the relevant figures.

Benefits of Monitoring Inventory Turnover Ratio

Understanding and tracking this ratio can lead to several advantages for your business:

1. Improved Cash Flow

By moving inventory faster, businesses free up capital that would otherwise be tied up in unsold products.

2. Reduced Holding Costs

Lower inventory levels mean reduced storage, insurance, and maintenance costs.

3. Better Purchasing Decisions

A turnover ratio helps in forecasting demand, preventing stockouts, and avoiding overstock situations.

4. Enhanced Profitability

Efficient inventory management often translates to higher sales and reduced markdowns or waste.

Tips to Improve Your Inventory Turnover Ratio

If your inventory turnover ratio is lower than desired, here are some strategies to consider:

- Review your stock regularly: Identify slow-moving products and consider discounts or promotions.

- Refine your purchasing: Avoid bulk buying that could lead to excess stock.

- Improve demand forecasting: Use historical sales data and market trends.

- Streamline operations: Enhance your supply chain to speed up restocking.

- Enhance marketing: Drive sales through targeted campaigns to move inventory faster.

Conclusion

The inventory turnover ratio calculator example provides a clear and practical way to understand this key performance indicator. By calculating and analyzing your inventory turnover ratio, you can gain valuable insights into your inventory management efficiency, leading to smarter purchasing, better cash flow, and heightened profitability. Whether you’re a small business owner or a large retailer, keeping an eye on this metric is essential for maintaining a healthy and agile operation.

Leveraging tools like online calculators can make the process easier and more accurate—so why not try one today with your own business numbers? The right inventory management strategy could be just a few calculations away.