- Understanding Working Capital Calculator Small Business: A Practical Example

- What Is Working Capital and Why Is It Important?

- How Does a Working Capital Calculator Small Business Tool Help?

- Components of Working Capital: What to Include

- Working Capital Calculator Example for Small Business

- Tips for Managing Working Capital in Small Businesses

- Conclusion

Understanding Working Capital Calculator Small Business: A Practical Example

Running a small business requires keen financial management to ensure smooth operations and growth. One essential financial metric that every small business owner should regularly monitor is working capital. Using a working capital calculator small business tool can simplify this task, providing a clear picture of your company’s short-term financial health. In this article, we’ll explore what working capital is, how a working capital calculator works, and walk you through a practical example tailored for small businesses.

What Is Working Capital and Why Is It Important?

Working capital represents the difference between a company’s current assets and current liabilities. In simple terms, it’s the money a business has available to cover its day-to-day operational expenses such as inventory, payroll, rent, and other short-term obligations.

A positive working capital indicates that a business can pay off its short-term liabilities with its short-term assets, which demonstrates financial stability. Conversely, negative working capital might signal liquidity problems, affecting the company’s ability to operate efficiently.

For small business owners, keeping a close eye on working capital helps prevent cash flow hiccups and supports sustainable growth.

How Does a Working Capital Calculator Small Business Tool Help?

Manual calculations of working capital can be tedious and error-prone, especially for non-finance experts. A working capital calculator small business is an intuitive online tool that allows business owners to input financial data—such as current assets and current liabilities—and automatically computes working capital.

Benefits of using such a calculator include:

- Quick Assessment: Instantly determine your working capital without delving deep into balance sheets.

- Improved Financial Planning: Spot potential cash flow problems early and adjust strategies accordingly.

- Enhanced Decision Making: Make informed decisions about investments, inventory management, or hiring based on working capital status.

Components of Working Capital: What to Include

Before diving into calculations, it’s important to understand what goes into working capital:

-

Current Assets: These are assets expected to be converted into cash within a year. Examples include:

- Cash and cash equivalents

- Accounts receivable (money owed by customers)

- Inventory

- Prepaid expenses

-

Current Liabilities: Obligations due within one year. Examples include:

- Accounts payable (money owed to suppliers)

- Short-term loans

- Accrued expenses (e.g., wages payable)

- Taxes payable

Working Capital Calculator Example for Small Business

Let’s walk through a detailed example to demonstrate how the working capital calculator small business tool works.

Step 1: Gather Financial Data

Imagine you own a small retail business. Here’s your snapshot for the current fiscal year:

| Current Assets | Amount ($) |

|---|---|

| Cash | 15,000 |

| Accounts Receivable | 25,000 |

| Inventory | 40,000 |

| Prepaid Expenses | 5,000 |

| Total Current Assets | 85,000 |

| Current Liabilities | Amount ($) |

|---|---|

| Accounts Payable | 30,000 |

| Short-term Loans | 20,000 |

| Accrued Expenses | 10,000 |

| Taxes Payable | 5,000 |

| Total Current Liabilities | 65,000 |

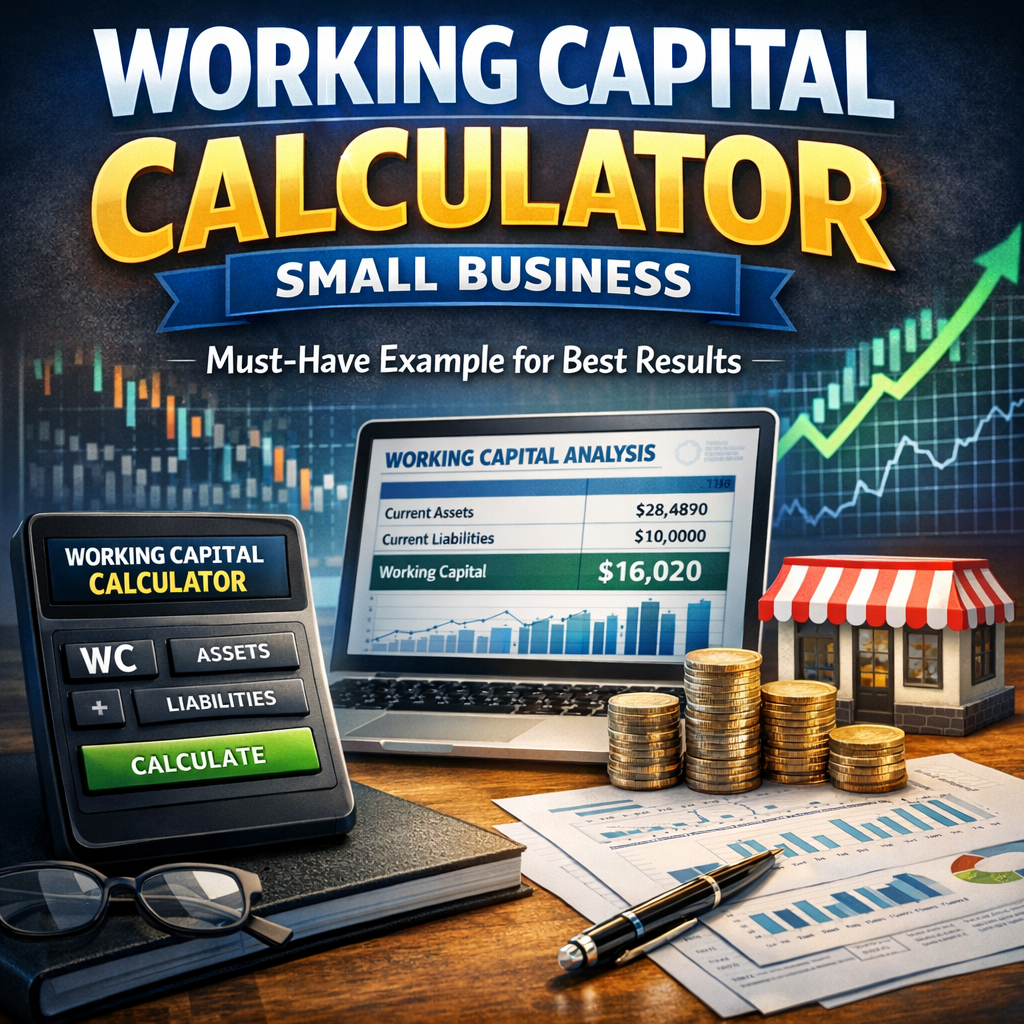

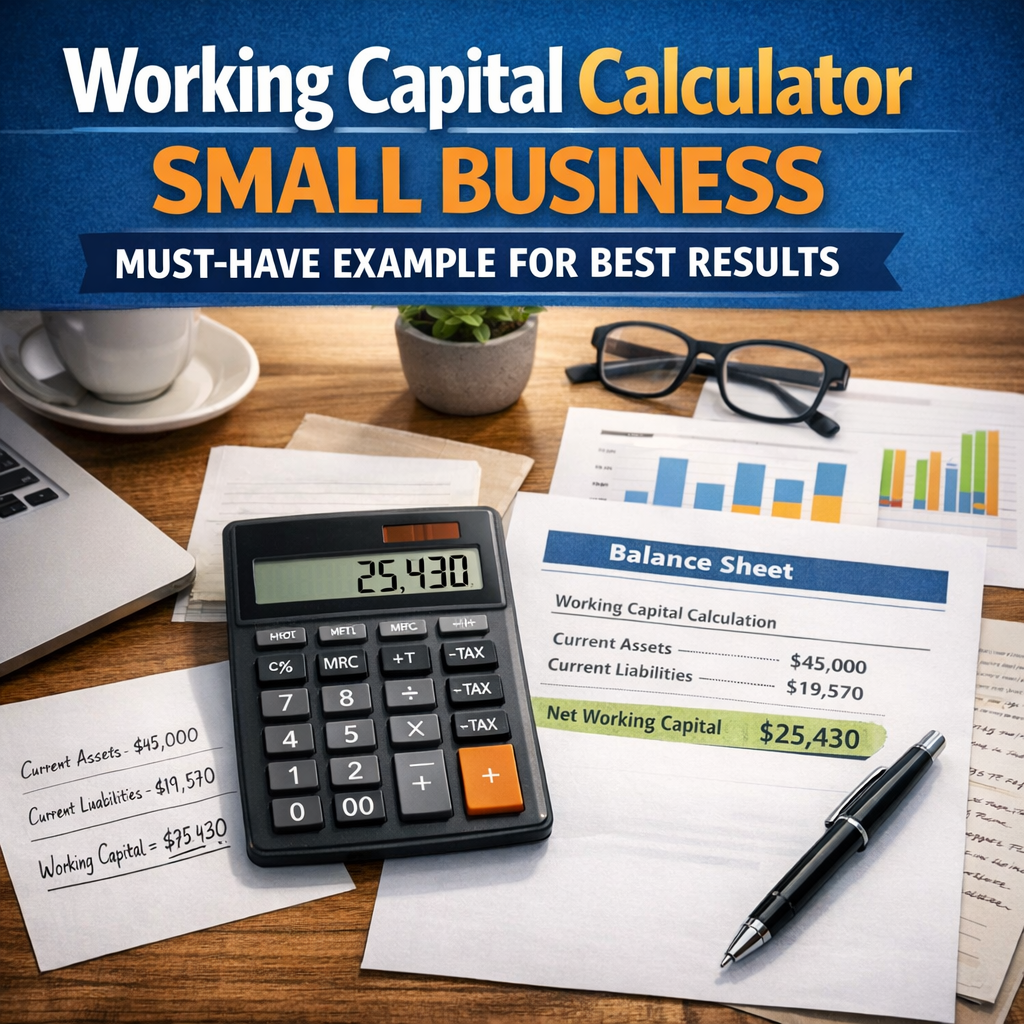

Step 2: Input Data into the Calculator

Enter the total current assets ($85,000) and total current liabilities ($65,000) into your working capital calculator.

Step 3: Calculate Working Capital

Using the formula:

Working Capital = Current Assets – Current Liabilities

The calculator computes:

85,000 – 65,000 = 20,000

This means your working capital is $20,000.

Step 4: Interpret Results

A working capital of $20,000 indicates that your business has $20,000 more in short-term assets than short-term liabilities. This positive balance suggests you are in a good position to cover your short-term debts and have a financial cushion to handle unexpected expenses or invest in growth opportunities.

Tips for Managing Working Capital in Small Businesses

Understanding your working capital is just the first step. Here are some tips to maintain or improve it:

- Optimize Inventory Levels: Avoid overstocking to reduce cash tied up in unsold products.

- Speed Up Accounts Receivable: Encourage customers to pay faster with discounts or clear payment terms.

- Negotiate Payment Terms: Extend accounts payable terms without damaging supplier relationships.

- Monitor Cash Flow: Regularly review cash inflows and outflows to anticipate gaps.

- Control Expenses: Keep operational costs in check to avoid unnecessary financial strain.

Conclusion

Using a working capital calculator small business tool is a smart and efficient way for business owners to keep track of their financial health. By regularly calculating and analyzing working capital, you can gain valuable insights into your company’s short-term liquidity, allowing you to make informed decisions that drive stability and growth. Whether you’re planning to expand, secure financing, or simply want to maintain smooth operations, understanding and managing your working capital effectively is key to success.