- What Is a Systematic Transfer Plan (STP)?

- How Does an STP Calculator Help?

- STP Calculator Systematic Transfer Plan Example

- Scenario

- Step 1: Using the STP Calculator

- Step 2: Understanding the Results

- Interpreting Outcomes

- Benefits of Using an STP Calculator

- Conclusion

Understanding STP Calculator Systematic Transfer Plan Example: A Comprehensive Guide

The STP calculator systematic transfer plan is an essential tool for investors who want to manage their mutual fund investments efficiently over time. Whether you are new to mutual funds or looking to optimize your investment approach, understanding how a systematic transfer plan (STP) works and how the STP calculator can help is invaluable. This article will break down the concept of STP, demonstrate how an STP calculator works, and provide an illustrative example to help you make informed investment decisions.

What Is a Systematic Transfer Plan (STP)?

A systematic transfer plan is an investment strategy that allows you to transfer a fixed amount of money from one mutual fund scheme to another at regular intervals. Typically, this involves moving funds from a debt fund (considered a safer option) to an equity fund (which has the potential for higher growth but also higher risk). The main purpose of an STP is to reduce market risks by spreading out investments over time, rather than investing a lump sum all at once.

This strategy is particularly useful during volatile market conditions or for investors who want to gradually enter equity markets while cushioning their portfolios from market shocks. Instead of timing the market, STP advocates time diversification, which can lead to cost averaging and better control over investment risks.

How Does an STP Calculator Help?

An STP calculator systematic transfer plan tool allows investors to estimate the future value of their investments based on parameters such as the transfer amount, frequency, duration, and expected returns of both the source and target schemes. This calculator helps in simulating different scenarios, enabling investors to plan their transfers intelligently and align them with their financial goals.

By using an STP calculator, you can:

- Assess the potential growth of your transferred investments.

- Understand the impact of different transfer frequencies (monthly, quarterly, etc.).

- Plan better when to start or stop transfers based on your financial plans.

- Visualize how spreading investments over time affects returns compared to lump sum investing.

STP Calculator Systematic Transfer Plan Example

To make the concept clear, let’s walk through a practical example of how an STP calculator can help you plan your transfers.

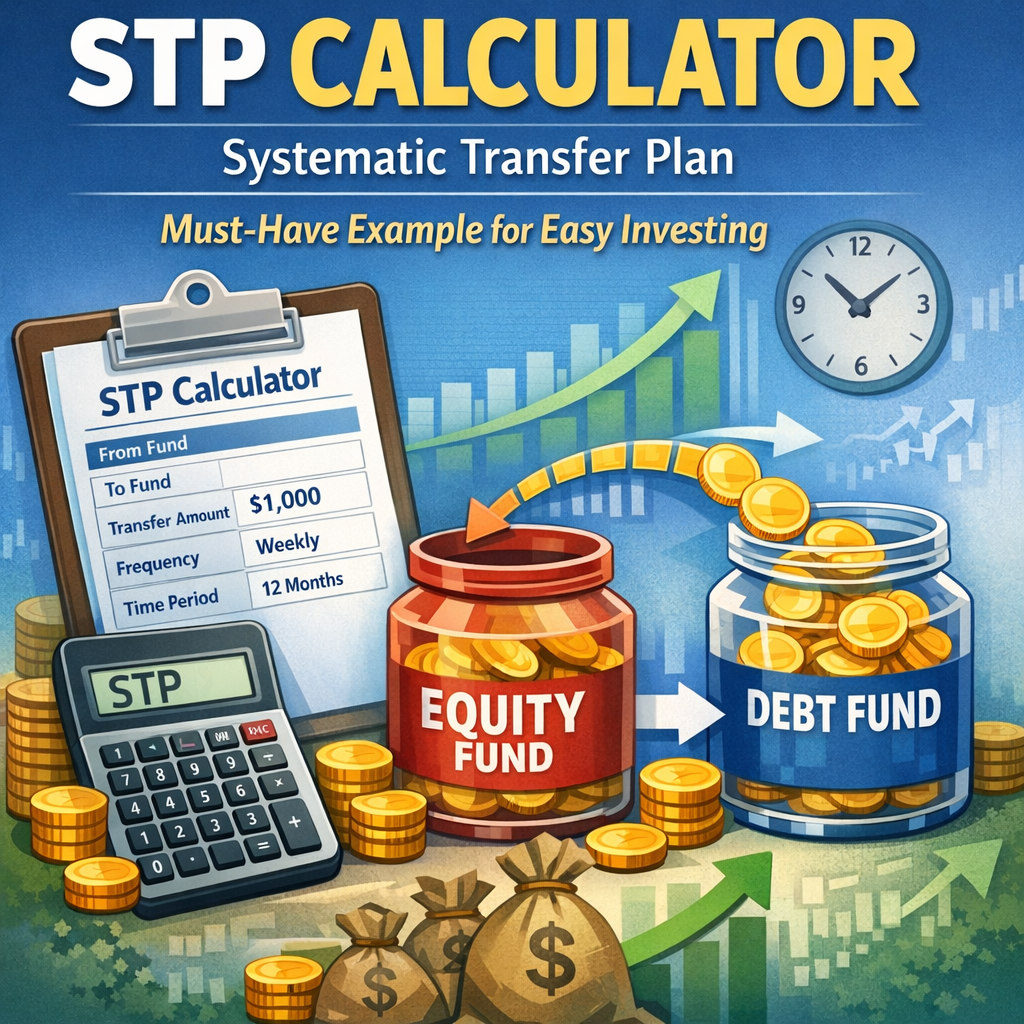

Scenario

- Initial investment in a debt fund: ₹1,00,000

- Monthly transfer amount to an equity fund: ₹5,000

- Transfer period: 12 months

- Expected return of debt fund: 6% per annum

- Expected return of equity fund: 12% per annum

Step 1: Using the STP Calculator

When you input the above details into the STP calculator, it will compute:

- How your ₹1,00,000 initial investment in the debt fund will grow during the 12-month transfer period.

- The cumulative amount transferred over 12 months (₹5,000 x 12 = ₹60,000).

- What the equity fund investment value will be at the end of 12 months, assuming monthly contributions are invested immediately and accrue returns at 12% per annum.

Step 2: Understanding the Results

Let’s break down the calculations:

- The debt fund’s value reduces each month by ₹5,000 (due to transfer), but the remaining balance continues to grow at 6%.

- The equity fund accumulates monthly ₹5,000 contributions, each growing at 12% annually from the date of transfer.

This blended approach ensures you steadily move money into a higher-growth equity fund while maintaining some safety with the debt fund, thereby reducing the risk of investing a lump sum at the wrong time.

Interpreting Outcomes

Using the calculator, you might see that after 12 months:

- Your debt fund balance reduces but still grows moderately.

- Your equity fund balance grows significantly due to higher returns and consistent monthly transfers.

- The overall portfolio benefits from reduced volatility and better time-averaged entry into the equity market.

Benefits of Using an STP Calculator

- Customization: Tailor your transfer plan to match your risk appetite and financial goals.

- Risk Management: Calculate potential exposure and avoid lump-sum market timing mistakes.

- Financial Discipline: Stay committed to regular investing with clear numerical goals.

- Informed Decisions: Compare different transfer amounts and intervals quickly.

Conclusion

An STP calculator systematic transfer plan empowers investors to adopt a smart and disciplined investment strategy by facilitating systematic transfers from one mutual fund scheme to another. Through its ability to model returns and timelines, the STP calculator aids in making better financial decisions, especially in fluctuating market conditions. Whether you’re planning to start with small transfers or want to balance your equity and debt allocation without guesswork, using an STP calculator along with a systematic transfer plan can be a strategic step toward achieving your financial goals with lower risk.

Investors should always remember to review the actual performance data and fund specifics along with using the STP calculator for a more comprehensive investment approach. With consistent planning and the right tools, disciplined investing through an STP can be a game-changer in your mutual fund journey.