- Understanding SWP Calculator Monthly Withdrawal: A Practical Example

- What is an SWP Calculator Monthly Withdrawal?

- Why Use an SWP Calculator?

- SWP Calculator Monthly Withdrawal Example: Step-by-Step

- Scenario:

- Step 1: Input Data into the SWP Calculator

- Step 2: Calculating Monthly Withdrawals

- Step 3: Understanding the Outcome

- Benefits of Using a Monthly SWP Withdrawal Strategy

- Important Considerations When Using an SWP Calculator

- Conclusion

Understanding SWP Calculator Monthly Withdrawal: A Practical Example

When planning your investments and retirement income, the term SWP calculator monthly withdrawal often comes up. An SWP, or Systematic Withdrawal Plan, provides investors with a disciplined way to withdraw money from their mutual fund investments on a regular basis—typically monthly—to meet their income needs. Using an SWP calculator monthly withdrawal tool can help individuals estimate how much they can withdraw each month without depleting their corpus too quickly. In this article, we’ll explore how an SWP calculator works, why it’s useful, and walk you through a detailed monthly withdrawal example to illustrate its practicality.

What is an SWP Calculator Monthly Withdrawal?

An SWP calculator monthly withdrawal is an online tool designed to help investors calculate the monthly amount they can withdraw from their mutual fund investments systematically. Instead of taking out random sums or liquidating the entire fund at once, a Systematic Withdrawal Plan allows for steady income over a period, while the remaining corpus continues to earn returns.

Typically, SWP calculators take into account factors such as:

- The initial investment amount

- The expected rate of return on the investment

- The monthly withdrawal amount

- The investment period or duration over which the withdrawals will be made

By inputting these details, the calculator estimates whether the corpus will last for the desired period or if adjustments are needed.

Why Use an SWP Calculator?

Planning financial withdrawals can be tricky. Without careful planning, there’s a risk of withdrawing too much too soon and depleting your funds prematurely. Conversely, withdrawing too little could mean missing out on using the money for essential needs. An SWP calculator monthly withdrawal tool aids in:

- Precision: Helps calculate sustainable withdrawal amounts based on realistic return assumptions.

- Confidence: Provides a sense of assurance about how long your retirement corpus or investment will last.

- Flexibility: Allows you to experiment with different withdrawal rates, timeframes, and return assumptions.

SWP Calculator Monthly Withdrawal Example: Step-by-Step

Let’s walk through an example showcasing how an SWP calculator works in a real-world scenario.

Scenario:

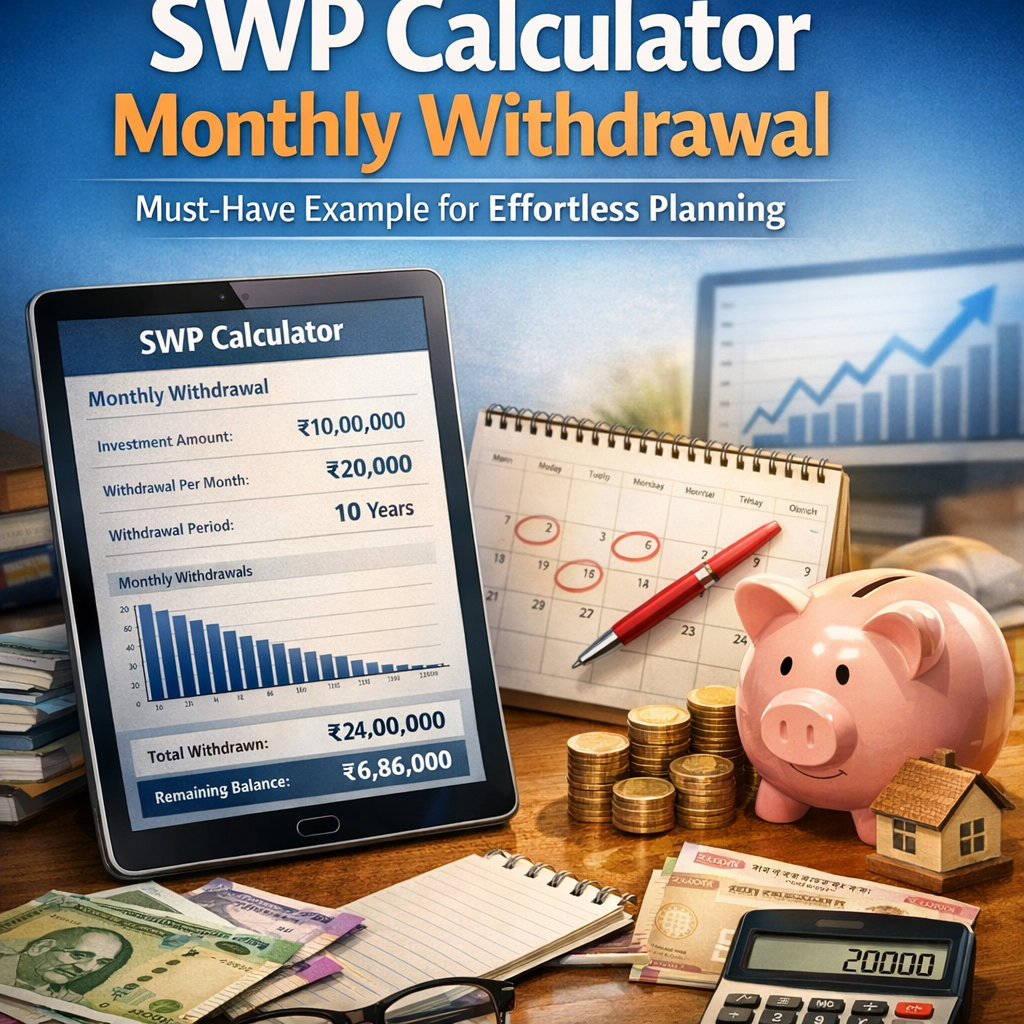

Prakash, aged 55, plans to retire soon and has an investment corpus of Rs. 20 lakhs in a balanced mutual fund. He wants to withdraw a monthly income to cover his living expenses over the next 15 years. He expects an average annual return of 8% from his investment and wonders how much he can safely withdraw every month.

Step 1: Input Data into the SWP Calculator

- Initial investment: Rs. 20,00,000

- Expected annual return: 8% (which translates roughly to 0.66% monthly compounded)

- Withdrawal period: 15 years (180 months)

- Withdrawal frequency: Monthly

Step 2: Calculating Monthly Withdrawals

Using the SWP calculator monthly withdrawal function, Prakash inputs these values. The calculator uses the formula for amortizing the corpus based on the withdrawal amount, investment returns, and time period:

PMT = P × [r × (1+r)^n] / [(1+r)^n – 1]

Where:

- PMT = Monthly withdrawal amount

- P = Principal amount (initial investment)

- r = Monthly rate of return (annual return / 12)

- n = Number of months

Plugging in the values:

- P = Rs. 20,00,000

- r = 0.08 / 12 = 0.00667

- n = 180

The calculator returns a monthly withdrawal amount of approximately Rs. 18,840.

Step 3: Understanding the Outcome

This means Prakash can withdraw roughly Rs. 18,840 every month for the next 15 years, assuming an 8% annual return is maintained. At the end of 15 years, the corpus will be close to zero, indicating optimal utilization of his investment.

Benefits of Using a Monthly SWP Withdrawal Strategy

- Steady income stream: Helps retirees or investors receive a fixed amount regularly to meet day-to-day expenses.

- Compounding benefits: As the corpus continues to earn returns, it works harder to sustain the monthly payouts.

- Financial discipline: Encourages consistent withdrawal instead of ad-hoc or emergency-driven liquidation.

- Tax efficiency: SWPs are often more tax efficient compared to lump-sum redemptions in mutual funds.

Important Considerations When Using an SWP Calculator

While SWP calculators offer a reliable starting point, keep these factors in mind:

- Rate of return may vary: Market volatility can impact the real returns on mutual funds.

- Inflation impact: Monthly withdrawals should ideally account for inflation, as the cost of living rises over time.

- Tax implications: Withdrawal amounts might be subject to capital gains tax, varying based on holding periods and fund categories.

- Emergency buffer: It’s wise to keep some funds aside for unforeseen expenses instead of pegging everything to systematic withdrawals.

Conclusion

Using an SWP calculator monthly withdrawal tool is a smart way to plan your regular income from investments efficiently. By understanding your corpus’s growth potential and withdrawal needs, you can ensure that your money lasts as long as you need it to. The example of Prakash perfectly illustrates how an SWP calculator enables you to fine-tune your monthly withdrawals, balancing income needs with investment longevity. Whether you are a retiree or someone looking to manage cash flow from your mutual funds, incorporating SWPs into your financial planning can be a game-changer in achieving financial stability and peace of mind.