- How to Use a Personal Loan EMI Calculator for a 5 Year Example

- What is a Personal Loan EMI Calculator?

- Why Use a Personal Loan EMI Calculator 5 Year example?

- How to Calculate EMI Using a Personal Loan EMI Calculator 5 Year

- Understanding the EMI Breakdown

- Benefits of Using a Personal Loan EMI Calculator 5 Year Example

- Factors Affecting the EMI for a 5-Year Personal Loan

- Tips for Managing Your Personal Loan EMI Efficiently

- Conclusion

How to Use a Personal Loan EMI Calculator for a 5 Year Example

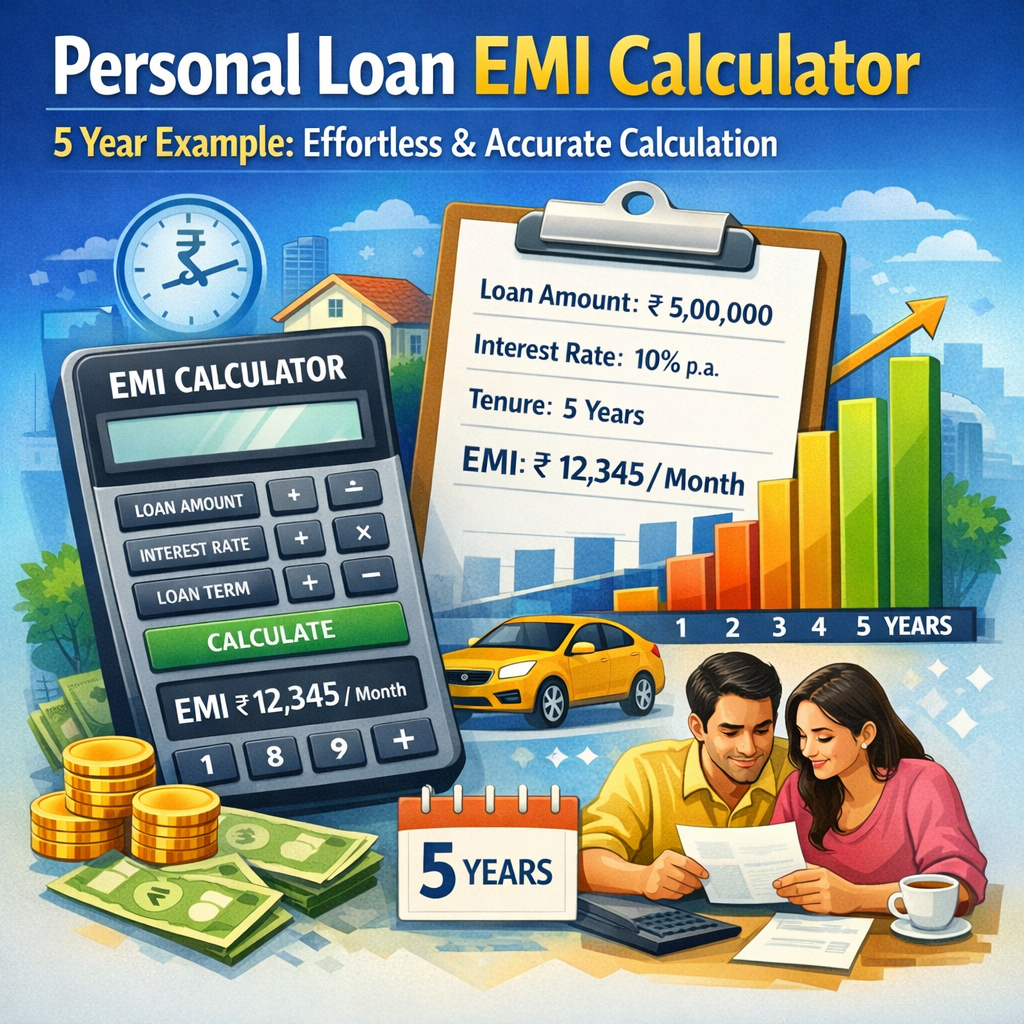

When planning to take a personal loan, understanding your monthly repayment obligations is crucial. This is where a personal loan EMI calculator 5 year plays a vital role. It helps borrowers estimate the Equated Monthly Installment (EMI) they will need to pay over a tenure of five years, allowing for effective financial planning and budgeting. In this article, we will explore how to use a personal loan EMI calculator for a 5-year loan example, the benefits of doing so, and important factors to keep in mind.

What is a Personal Loan EMI Calculator?

A personal loan EMI calculator is an online tool designed to simplify the process of calculating loan repayments. It uses the principal loan amount, interest rate, and tenure to compute the fixed monthly payment that a borrower needs to make until the loan tenure ends. This calculator is especially valuable because it helps visualize the financial commitment before signing any loan agreement.

Why Use a Personal Loan EMI Calculator 5 Year example?

Choosing a 5-year tenure for a personal loan is quite common, as it strikes a balance between manageable EMIs and total interest outgo. However, it can sometimes be confusing to estimate monthly payments manually, especially if you are not comfortable with financial formulas. Using an EMI calculator streamlines this process, offering quick and accurate results that help you make informed decisions.

How to Calculate EMI Using a Personal Loan EMI Calculator 5 Year

Using a personal loan EMI calculator for a 5-year term is straightforward. Here’s a step-by-step guide:

- Input the Loan Amount: This is the total sum you wish to borrow. For example, assume you need ₹5,00,000.

- Enter the Interest Rate: This is the annual interest rate the lender charges. Suppose it is 12% per annum.

- Set the Tenure to 5 Years: This means the loan repayment period will be 60 months.

- Calculate the EMI: Click on the ‘Calculate’ button, and the tool will compute your monthly installment.

For example, borrowing ₹5,00,000 at 12% interest for five years will result in an EMI of approximately ₹11,124 per month.

Understanding the EMI Breakdown

The monthly EMI consists of both the principal and interest components. In the initial stages of the loan, a larger portion of the EMI goes toward paying the interest, while later months primarily reduce the principal. The personal loan EMI calculator usually provides an amortization schedule highlighting these details, helping you understand how your payments evolve over time.

Benefits of Using a Personal Loan EMI Calculator 5 Year Example

- Budget Planning: Knowing your EMI upfront assists you in managing your monthly expenses without stretching your finances.

- Loan Comparison: You can enter different interest rates or principal amounts to compare offers from various lenders easily.

- Interest Cost Awareness: The calculator shows you the total interest payable over the five years, enabling you to evaluate the cost-effectiveness of your loan.

- Prepayment Insight: Many EMI calculators can factor in prepayment amounts, helping you visualize savings on interest and reduced tenure.

Factors Affecting the EMI for a 5-Year Personal Loan

Several variables influence the monthly EMI amount:

- Interest Rate: Even a small change in the rate affects the EMI substantially.

- Loan Amount: The higher the loan principal, the higher the EMI.

- Processing Fees: Some lenders charge fees that affect your total payable amount and might impact your cash flow.

- Prepayment and Foreclosure: Options to repay part of the loan early can reduce the tenure and interest outgo.

Tips for Managing Your Personal Loan EMI Efficiently

- Keep Track of Payment Dates: Missing EMI payments can lead to penalties and affect your credit score.

- Consider a Comfortable EMI: Use the calculator to ensure the EMI doesn’t strain your monthly budget.

- Look for Flexible Tenure Options: Although five years is popular, some lenders may allow shorter or longer tenures at different rates.

- Evaluate Prepayment Terms: Understand the lender’s prepayment policy to save on interest without incurring hefty prepayment charges.

Conclusion

Using a personal loan EMI calculator 5 year example is an effective way to gain clarity on monthly repayment amounts and total interest costs for a five-year personal loan. Such calculators empower borrowers to tailor loan options that perfectly fit their financial situation, avoid surprises, and manage credit responsibly. Before finalizing your loan, always leverage these tools to ensure you are fully informed and prepared to handle the repayment journey with confidence.