- Understanding Mortgage Affordability with a Mortgage Affordability Calculator UK Example

- What is a Mortgage Affordability Calculator UK?

- How Does a Mortgage Affordability Calculator UK Work?

- Mortgage Affordability Calculator UK Example

- Why Use a Mortgage Affordability Calculator UK?

- Tips For Using Mortgage Affordability Calculators Effectively

- Final Thoughts

Understanding Mortgage Affordability with a Mortgage Affordability Calculator UK Example

When planning to buy a home in the UK, one of the most important steps is determining how much you can realistically afford to borrow. This is where a mortgage affordability calculator UK. For a related walkthrough that converts affordability figures into monthly EMIs (example: 7% interest over 10 years), see: https://finlaa.com/emi-calculator-7-percent-interest-10-years/ becomes an invaluable tool. Such calculators help potential homebuyers estimate their borrowing capacity based on their financial situation, making the often complex process of obtaining a mortgage more transparent and manageable.

In this article, we’ll explore how a mortgage affordability calculator works, why it’s essential for homebuyers in the UK, and provide a practical example to illustrate how these tools can guide you in making informed borrowing decisions.

What is a Mortgage Affordability Calculator UK?

A mortgage affordability calculator UK is an online tool designed to assess how much mortgage you can afford based on your income, expenses, and financial commitments. Unlike simple mortgage calculators that focus mostly on the monthly payment (for an illustrative EMI computation at 7% over 10 years, try the EMI Calculator 7 Percent Interest 10 Years: https://finlaa.com/emi-calculator-7-percent-interest-10-years/) (see Home Loan EMI Calculator Processing Fee guide) for a given loan amount and interest rate, affordability calculators take a broader view. They consider your income, outgoings, existing debts, and sometimes credit history, to estimate a realistic mortgage amount you are likely to be approved for.

These calculators help both first-time buyers and experienced homeowners understand their financial boundaries when entering the property market. Because mortgage lenders in the UK apply strict criteria, including stress tests and income multiples, using an affordability calculator gives a clearer picture ahead of application.

How Does a Mortgage Affordability Calculator UK Work?

When you use a mortgage affordability calculator, you typically input:

- Your gross annual income (salary before tax)

- Any additional income (bonuses, rental income, etc.)

- Monthly debts and financial obligations (credit card payments, loans, maintenance payments)

- Living expenses (sometimes optional)

- Desired mortgage term (usually 25 years by default)

- Estimated interest rate (to check monthly repayment feasibility)

The calculator considers these inputs and applies lending rules, by multiplying income against a specific factor (usually 4 to 4.5 times your income), and subtracting your monthly commitments to estimate your borrowing capacity.

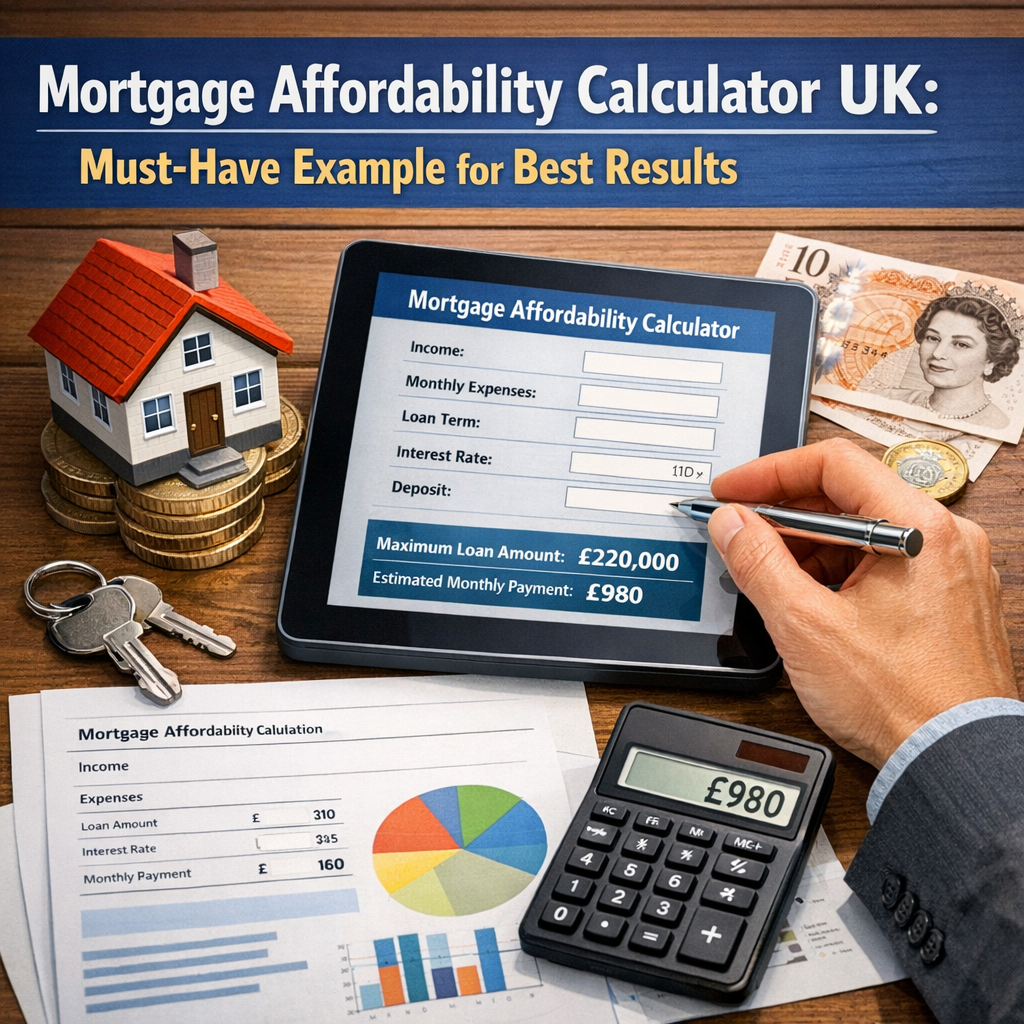

Mortgage Affordability Calculator UK Example

To better understand the functionality, let’s look at an example scenario:

Profile:

- Annual gross income: £45,000

- Additional income: £5,000 rental income per year

- Monthly debts: £200 (loan repayments)

- Monthly living expenses (estimated): £800

- Desired mortgage term: 25 years

- Estimated interest rate: 5%

Step 1: Income Calculation

Total annual income = £45,000 + £5,000 = £50,000

Mortgage lenders in the UK typically loan around 4.5 times your income (variable depending on lender and financial background).

Maximum potential mortgage = 4.5 × £50,000 = £225,000

Step 2: Debt and Expenses Assessment

Lenders will consider your debts and living expenses as part of affordability checks. While living expenses can be subjective, debts are more strictly measured.

Monthly debts: £200

Estimated expenses: £800

Total monthly obligations: £1,000

Step 3: Calculating Monthly Mortgage Cost

At 5% interest for 25 years, a mortgage of £225,000 has an estimated monthly repayment of around £1,300.

Adding debts and expenses:

£1,300 (mortgage) + £200 (debts) + £800 (expenses) = £2,300 per month total financial burden.

Step 4: Comparison with Income

Monthly gross income = £50,000 / 12 = £4,167

After tax (approx. 25% tax rate) = £3,125 (net disposable income)

The mortgage repayment and expenses total £2,300, which leaves around £825 disposable income for other needs. This shows that borrowing £225,000 is feasible, though lenders may adjust the amount based on stricter affordability criteria.

Why Use a Mortgage Affordability Calculator UK?

- Avoid Overborrowing: By clearly showing how much you can afford, these calculators prevent you from borrowing more than your financial situation supports.

- Simplifies Planning: Helps plan your property search around properties you are more likely to afford.

- Speeds Up Decisions: Provides early insight before engaging with lenders or brokers.

- Tailors to UK Market: Takes into account specific UK lending rules and typical income multiples applied by UK mortgage providers.

Tips For Using Mortgage Affordability Calculators Effectively

- Calculate real income: Include all regular income sources.

- Be honest about debts: List all monthly repayments to get an accurate estimate.

- Use realistic interest rates: Check current market rates to avoid underestimating payments.

- Try multiple calculators: Different tools have different assumptions; comparing outputs helps better prepare.

Final Thoughts

A mortgage affordability calculator UK is an essential instrument for homebuyers to realistically estimate how much they may be able to borrow. By considering both income and expenditures, these calculators offer a holistic view of affordability in the UK’s evolving property market. The example outlined here illustrates the typical inputs and outputs, empowering prospective buyers with practical insights.

If you’re planning to step into the home ownership journey, starting with a mortgage affordability calculator can save time, reduce stress, and guide you to make informed, confident financial decisions.